In today’s fast-moving financial world, knowing your way around financial instruments is a game-changer. Whether you’re into stocks or bonds, these tools are the backbone for managing your money and risk, helping everyone make much smarter investment choices.

According to Great Eastern, an OCBC survey found that 68% of Singaporeans invest, averaging S$20,000. Younger people aged 25 to 44 typically invest 15-17% of their pay. This shows a huge rise in people using financial instruments as essential tools to build their wealth and handle risks.

Because of this, this article will dive deep into financial instruments, define what financial instruments are, and how they’re used to optimize wealth. We’ll explore different types of financial instruments, including cash, equity, and derivative-based instruments, to help manage these financial assets efficiently.

- A financial instrument is a contract or asset you can exchange that holds monetary value, basically, that ties one party’s obligation to another.

- The three main types of financial instruments are cash, derivatives, and foreign exchange instruments, each serving unique business needs.

- Key characteristics of financial instruments include liquidity, risk-return profile, maturity, and marketability, which influence financial decisions.

- ScaleOcean’s accounting software simplifies the management of financial instruments, helping businesses automate processes and reduce risk.

What Is a Financial Instrument?

A financial instrument is a contract or asset you can exchange that holds monetary value, basically, that ties one party’s obligation to another. For example, it’s like an agreement that’s written in numbers, whether it’s lending money, buying shares, or anything else with financial weight behind it.

They can be simple, like a savings account, or more complex, like derivatives that involve layers of conditions. The main idea behind financial instruments is that they help people or businesses handle money, whether that’s for earning returns, protecting against losses, or moving capital around more efficiently.

Also Read: A Comprehensive Guide to Financial Management

Types of Financial Instruments

Financial instruments are vital for protecting and growing your business assets. They act as handy tools for investing, managing risk, and funding your plans. By knowing the different types, you can make smarter choices to reach your goals while keeping risks low. Here are the main categories of financial instruments:

Cash Instruments

Cash instruments are probably the most straightforward kind of financial asset out there. We’re talking about things like treasury bills, bank deposits, and loans, assets whose value is set directly by the market. Proper bank reconciliation ensures these transactions are accurately reflected in your accounts, maintaining consistency.

Since they’re usually easy to convert to cash, they tend to work well for short-term planning or quick liquidity needs. A lot of businesses lean on them just to manage daily operations or to stash extra funds without tying them up for too long.

Derivative Instruments

Derivative instruments are basically contracts that get their value from something else, like a stock, bond, or sometimes even a rate like interest. You’ll often hear about things like futures, options, or swaps being used in this space, and each one plays a different role depending on the situation.

They’re mostly used either to protect against risks or to take a bet on market movements, depending on what you’re aiming for. They can be complex to navigate, but when used right, they offer a practical way to manage uncertainty or lock in certain positions over time.

Foreign Exchange Instruments

When companies are dealing across borders, foreign exchange instruments tend to come up pretty quickly. They’re not just about trading currency. They’re more about helping manage all the ups and downs that come with shifting exchange rates.

Tools like forward contracts or currency swaps are often used so businesses can sort of “lock in” a rate ahead of time. This kind of predictability helps keep things steady, especially when margins are tight and you’re trying to avoid surprises.

Asset Classes of Financial Instruments

When people bring up financial instruments, they’re usually referring to them by asset class is basically the bucket they fall into. The two big ones you’ll hear about most are debt-based and equity-based, and they each behave pretty differently.

One isn’t necessarily better than the other, so it really comes down to what you’re trying to achieve financially. Some businesses lean toward debt to keep their financial control, while others go the equity route to bring in investors without taking on liabilities. Below are the further details about the classification of financial instruments:

Debt-Based Financial Instruments

Debt instruments, such as bonds, loans, or even certain notes, basically let a company borrow money with a promise to pay it back later, usually with some interest attached. It’s a way to get funding without giving up ownership, which can be a smart move when control matters.

They’re typically seen as lower risk compared to equity options, mostly because there’s a clear repayment schedule in place. Still, there’s pressure to repay, which makes timing and cash flow kind of a big deal when companies go this route.

Equity-Based Financial Instruments

Equity instruments like stocks give you a real stake in a company. You’re essentially betting on its success for dividends or price growth. Clever inventory accounting helps manage these assets, which directly impacts their overall value and how the stock performs.

Now, there’s more risk involved with equities than with other types of financial instruments, but there’s also a better chance for higher returns. It’s a common route for businesses that want to bring in investors without taking on debt, which makes sense when cash flow’s tight or long-term growth is the focus.

4 Main Characteristics of Financial Instruments

When you look at any financial instrument, whether it’s a bond, a stock, or something more niche, it usually boils down to a few key traits. The main ones people tend to focus on are liquidity, risk versus return, how long it lasts (maturity), and how easily it can be traded or sold.

Each of these plays a role in figuring out whether an instrument makes sense for a particular strategy. Understanding these characteristics can really shape how financial professionals approach their planning or day-to-day decisions. So, here are the main characteristics:

1. Liquidity

Liquidity is basically about how fast you can turn a financial instrument into cash, without taking a loss in the process. Cash and equivalents tend to sit at the top when it comes to this, which makes sense since they’re already cash or pretty close to it.

If you’re dealing with short-term costs or sudden shifts in the market, having something liquid on hand helps a lot. On the flip side, illiquid assets might grow in value over time, but they can also lock up your funds when you need them most.

2. Risk and Return Profile

When it comes to financial instruments, there’s always some level of risk and return involved. It’s like nothing’s ever completely without tradeoffs. Lower-risk options tend to be more stable, but naturally, they don’t usually deliver high returns, while the riskier ones can offer bigger gains, though not without a fair bit of unpredictability.

Getting a feel for this risk-return balance is key, especially when you’re trying to map out investments that support your broader financial goals for business. It’s a practical way to stay aligned with what the business actually needs at different stages of growth.

3. Maturity

Maturity basically refers to how long a financial instrument stays active before it reaches the end of its term. Some wrap up in just a few days, while others might stretch out over several years, or even decades in some cases.

Picking the right maturity really comes down to a mix of things like your cash flow timing, risk appetite, and when you actually need the return. It’s not a one-size-fits-all situation, so what works for one business might not make sense for another.

4. Marketability

Marketability basically comes down to how quickly or easily someone can sell or pass a financial instrument to another party. That can shift depending on things like how complex the instrument is, what the current market looks like, and whether there’s strong enough demand behind it.

When something’s highly marketable, it gives businesses more room to move, especially when the market starts acting up. Having that kind of flexibility makes a real difference for companies that need to stay responsive and avoid getting stuck with something they can’t shift.

Because of this, ScaleOcean ERP offers a range of features and modules that support the key characteristics of financial instruments mentioned above. It enhances marketability, providing businesses with the flexibility to adapt quickly in a changing market, ensuring they’re always prepared for new opportunities.

What Are Some Examples of Financial Instruments?

Some of the more familiar examples of financial instruments include stocks, ETFs, mutual funds, real estate investment trusts (REITs), bonds, checks, certificates of deposit (CDs), bank deposits, and loans. Companies commonly use these for various financial purposes, depending on their structure or growth stage.

In addition, more complex financial instruments like interest rate swaps and credit derivatives come into play for larger firms or industries that require sophisticated financial strategies.

However, according to CGS International in 2025, with Singaporean youth having a digital financial literacy score of just 56.7, there’s a clear gap in understanding such advanced tools. These instruments are less common in everyday business accounting but serve key roles in risk management and advanced financial planning.

Significance of Financial Instruments

Financial instruments serve several functions in the global economy. They are essential for raising funds, managing risk exposure, and optimizing resource allocation. These tools help businesses navigate financial markets, support investment strategies, and ensure smoother financial planning, all of which contribute to economic stability and growth.

And when they’re combined with systems like financial audit platforms, it becomes easier to stay aligned with regulations. This kind of integration helps build trust across teams, investors, and anyone else watching the numbers.

How to Manage Financial Instruments Easily with ScaleOcean?

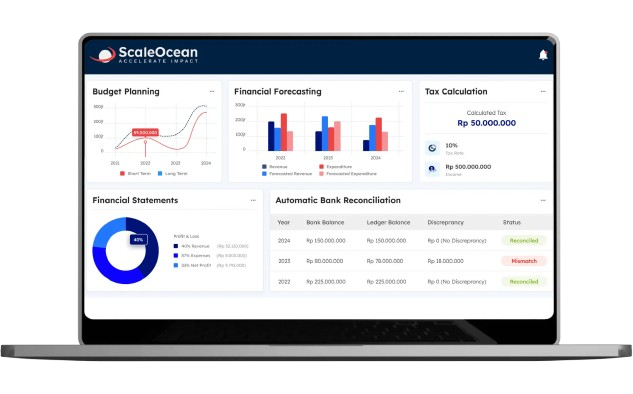

Handling financial tools is a breeze with ScaleOcean’s accounting software. By linking accounting with asset and revenue management, every stock or bond trade shows up instantly in your general ledger. It gives you one clear, unified view of your entire financial world.

ScaleOcean is an all-in-one solution that grows with you. Whether you’re a big player or a rising startup, the software is fully customizable to fit your specific workflows. This software makes sure that the platform adapts to your business, not the other way around.

ScaleOcean also helps you use CTC grants to get top-tier tools without the heavy price tag. By tapping into this support, you can sharpen your financial strategy and grow more efficiently, all while keeping your implementation costs much lower.

And here are the unique features that ScaleOcean has to offer:

- IFRS Compliance: Ensures financial records adhere to the latest IFRS standards, including IFRS 9/IFRS 109, for compliance with Singapore’s regulatory framework.

- AI Cash Flow Forecasting: Utilizes machine learning to analyze historical data and market trends, predicting future liquidity positions for better decision-making.

- Automated Receivables/Payables: Smart receivables and scheduling tools streamline payment processing, helping businesses manage cash flow efficiently.

- Asset and Investment Instrument Valuation: Maintains accurate asset and financial instrument valuations in real-time, ensuring precise balance sheet reporting.

- Smart Bank Reconciliation: Automatically matches transactions with high accuracy, even for those with non-identical descriptions, ensuring your cash balance is always up-to-date.

Besides the tools that were shared above, ScaleOcean offers extra modules and additional features that are built for your specific industry. These all-in-one solutions help you smooth out every part of your work. So, give ScaleOcean’s free demo a try to see the benefits and features for yourself!

Conclusion

Whether you’re handling simple cash deposits or navigating complex derivatives, financial instruments are central to business finance. They help manage risk, fund operations, and align your strategy with market conditions. But they also come with challenges like classification, tracking, and compliance can quickly become messy without the right tools.

That’s why ScaleOcean’s accounting software is the right solution for simplifying financial management. With its seamless integration, real-time updates, and AI-powered forecasting, you gain clarity and control over your finances. Plus, ScaleOcean offers a free demo so you can explore its unique features firsthand.

FAQ:

1. What are basic financial instruments?

Basic financial instruments are contracts that generate financial assets for one party and financial liabilities or equity for another. Examples include cash, loans, receivables, bonds, and stocks, which arise from standard business transactions and simple agreements.

2. What is a financial instrument according to IFRS?

According to IFRS, a financial instrument is any agreement that creates a financial asset for one party and a financial liability or equity for another. This standard governs how financial instruments should be recognized and measured in financial reporting.

3. What financial instrument is best for beginners?

For beginners, simple financial instruments like stocks, bonds, and mutual funds are the best options. These instruments are easier to understand, track, and trade, making them ideal for those who are new to investing.

4. What are Level 1, 2, 3 financial instruments?

Levels 1, 2, and 3 are categories used in the fair value measurement hierarchy in financial reporting. On level 1, instruments have prices quoted in active markets (like listed stocks). Level 2 uses observable market data other than quoted prices. Level 3 involves unobservable inputs based on models or assumptions.

PTE LTD..png)

.png)

.png)

.png)

.png)