Financial control refers to the policies, procedures, and systems a business puts in place to monitor, regulate, and protect its financial resources. It ensures the accuracy of financial reporting, safeguards assets from fraud or theft, and promotes operational efficiency.

Weak or poorly executed financial control policies and systems challenge many businesses, causing inaccurate data, increased fraud risk, inefficient operations, and subsequent financial losses, regulatory issues, and reputational damage. However, strong financial control is vital for asset protection and reliable financial management, safeguarding the business’s stability and growth.

According to the Association of Certified Fraud Examiners (ACFE), “More than half of occupational frauds occur due to a lack of internal controls or an override of existing internal controls.” This highlights the critical role of robust internal controls in preventing financial loss and maintaining the integrity of a business’s operations.

Therefore, this article offers a clear overview of financial control, covering its definition, processes, the financial controller’s role, governance, and the strategic implementation of advanced technologies such as ERP systems, all aligned with professional standards.

- Financial control is a comprehensive framework of policies and procedures designed to monitor, regulate, and protect a company’s resources while ensuring accurate reporting and efficiency.

- Financial Control Process: Maintaining financial health requires a continuous cycle of detecting anomalies, performing timely reviews, stress-testing operational scenarios, and utilizing advanced forecasting to mitigate risks.

- Importance of Financial Controls: These strategic tools are vital for maintaining cash flow, driving operational profitability, preventing fraudulent activities, and ensuring total compliance with global regulatory standards.

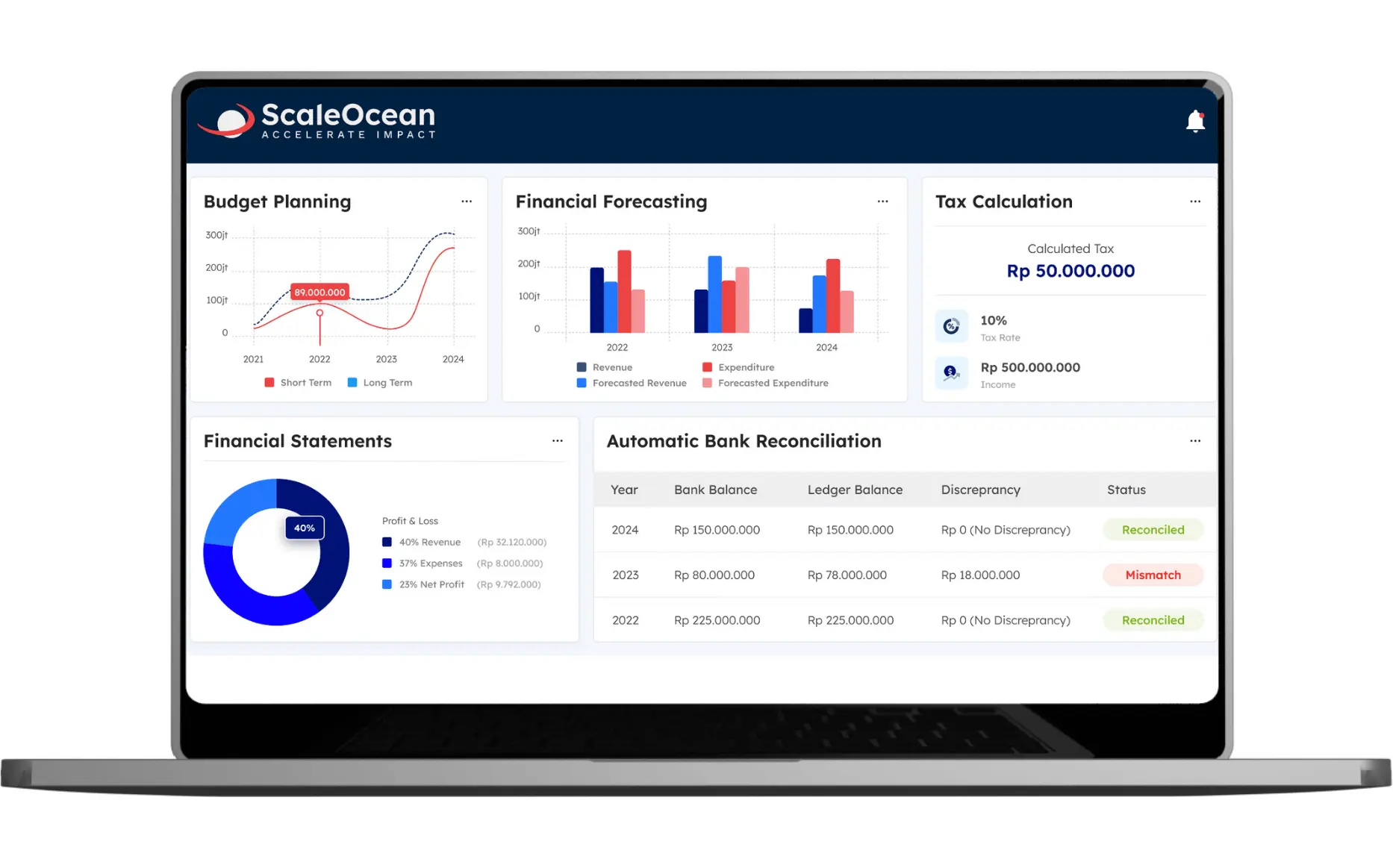

- ScaleOcean Accounting Software: You can achieve perfect financial control by using ScaleOcean, the best accounting software to automate your reporting, approvals, and real-time budget monitoring efforts.

What are Financial Controls?

Financial controls are a complete framework of policies and procedures used by a business to monitor, direct, and report the allocation and use of its financial resources. These operational checks ensure financial data accuracy, safeguard assets, and maintain efficient, compliant operations aligned with strategic goals.

Strategically, strong controls enable better financial management, efficient capital allocation, and increased profitability through informed planning and rigorous analysis. Importantly, they are the primary defense against financial misconduct, detecting and deterring fraud or asset misappropriation.

The modern concept also covers managing “financial control risk”, the chance that internal controls will fail to prevent financial statement errors. Therefore, a strong financial control system is a dynamic framework that adapts to the changing global risk landscape.

Also Read: Financial Management: Definition, Key Components, and Goals

Financial Control Process

Implementing financial controls is a continuous, cyclical process essential for maintaining the financial health of an enterprise. It moves beyond static accounting to active financial lifecycle management. As it also ensures complex financial instruments are recorded accurately and valued in line with relevant accounting standards.

1. Detecting Overlaps and Anomalies

Financial control begins with a meticulous, forensic examination of data. Controllers fundamentally act as financial detectives, scrutinizing budgets, financial reports, and ledgers to identify and address inconsistencies, such as inefficient operational overlaps and significant budget anomalies. While this process was traditionally manual, it has now become largely automated.

Anomalies that warrant investigation typically include abrupt, unexplained cost spikes or numerous small transactions that appear intentionally structured to avoid standard approval thresholds.

Modern financial control takes advantage of advanced Artificial Intelligence, which significantly enhances the financial control process and the detection process by learning patterns of ‘normal’ financial behavior and effectively flagging subtle deviations that would likely be missed by static, rule-based systems.

2. Timely Review and Updating

Timeliness refers to the swiftness and promptness of data reporting, ensuring that information is available when needed for decision-making. It also encompasses the regularity and frequency with which control reviews are conducted, guaranteeing that controls are assessed on a consistent and appropriate schedule.

Relying on outdated financial data is dangerous. Timely updating ensures that decision-makers are working with real-time insights regarding cash flow and liabilities.

Therefore, the controls must adapt as the business expands, such as for new products or markets. A timely review audits the control framework for drift from official policy. and reviews user access rights to prevent unneeded access to sensitive financial functions.

3. Analyzing All Possible Operational Scenarios

Before locking in a financial control strategy, it’s important to stress-test it against reality. This step involves hypothetical modeling and scenario planning. Financial controllers must understand how controls would function under extreme pressure.

For example, if transaction volume tripled overnight, would the manual reconciliation team be overwhelmed, leading to a breakdown? Or, in a crisis scenario where the system is taken offline by a cyberattack, are there manual fallback controls to ensure vendors still get paid?

By analyzing these diverse scenarios, businesses can design controls that are resilient rather than brittle, such as establishing contingent approval workflows or dynamic credit limits that adjust automatically to market volatility.

4. Forecasting and Making Projections

Forecasting provides navigation coordinates for your business. It involves using historical data, market trends, and statistical models to predict future financial performance. This is distinct from simple budgeting because it’s an estimation of likely future income and expenses.

Accountants might use advanced tools like linear regression to model these projections, plugging in inputs like raw material costs and labor rates to predict revenue. In the context of control, these forecasts act as a baseline.

If the control system detects that actual performance is deviating significantly from the forecast, such as expenses rising faster than predicted revenue, it triggers an alert for management to intervene. Thus, forecasting is about creating a standard against which reality is measured.

5. Assess Risk

Risk assessment is the systematic process of identifying where the business is vulnerable. In financial control, this means spotting potential threats to financial health and evaluating if existing shields are strong enough.

The lifecycle involves identification, categorization, and quantification. Then, risks are prioritized. A thorough assessment focuses resources on the areas of highest chance of exposure, ensuring that the most dangerous risks, those that could cause material errors in financial statements, are the most heavily guarded.

6. Make Projections

While forecasting is analytical, making projections in this context refers to the act of setting distinct, actionable targets based on those forecasts. For example, a business might project that a new product needs to sell 500 units a month to be viable.

Management tunes control mechanisms to enforce these projections, which become concrete goals such as “maintain a 20% operating margin” or “keep inventory turnover at 60 days.” The organization then designs financial control policies to ensure the business meets these projections. If a projection indicates a cash shortfall in Q3, management activates the control mechanism, such as stricter expense approvals, in Q1 to prevent it.

7. Create a Positive Work Environment

A work culture built on trust, transparency, and recognition significantly reduces the incentive for fraud. When employees feel their hard work is valued, they are psychologically more inclined to protect the company’s assets and adhere to internal controls.

Conversely, a toxic environment characterized by unrealistic targets or a lack of support can pressure employees into bypassing controls or manipulating data to meet expectations. Transparency from management regarding financial status fosters a sense of ownership, ensuring that the people are the strongest link in the control chain, not the weakest.

Why are Financial Controls Important?

Financial controls are the backbone of financial integrity, efficiency, and growth, ensuring companies stay on track with their long‑term financial goals for business. Beyond mere financial record-keeping, these are strategic tools vital for business viability.

They safeguard assets, prevent fraud, guarantee the accuracy of financial data, and empower management to make well-informed decisions. So, below are the key importance of financial controls:

Cash Flow Maintenance

Cash is the lifeblood of any business, so financial control acts as the heart that keeps it pumping. Through mechanisms like cash flow forecasting and daily reconciliations, controls ensure the business always has enough liquidity to meet its obligations.

According to a research article by Zippia, 82% of small businesses that fail experience cash flow problems, highlighting how critical sustainable financial control is for your business’s survival.

Financial control serves as a vital safeguard for a business’s well-being, preventing cash-flow blockages. They combat issues like uncollected receivables, measured by day sales outstanding, and uncontrolled spending, known as Maverick Spend, both of which pose a threat to the business’s financial health.

Operational Efficiency

In a competitive market, efficiency is key. Financial controls contribute to this by streamlining processes and cutting out fat. By detecting overlaps and anomalies, controls eliminate waste.

For example, a centralized vendor management control prevents different departments from negotiating different prices for the same service, maximizing purchasing power and standardizing operations.

Profitability

Ultimately, financial controls drive profitability. By preventing fraud and waste and ensuring resources are allocated to high-return activities, controls directly impact the bottom line.

They allow management to analyze performance against budgets, identifying areas where costs can be reduced or revenue enhanced. Accurate reporting also provides the reliable data needed for strategic decisions, like pricing or market entry.

Fraud Prevention Activity

Financial controls serve as the primary shield against fraudulent activities. They are designed to detect and deter employee theft and financial statement manipulation. Deterrence mechanisms, like segregation of duties and access restrictions, make it significantly harder for a single individual to commit and conceal fraud.

Regular audits act as the spotlight of operations where fraud typically festers. By systematically reviewing financial records and internal controls, audits can uncover irregularities, weak spots, and non-compliance, thereby significantly deterring potential fraudulent activities.

Maintain Compliance

In an era of stringent regulations (like SOX, GDPR, IFRS, PSAK), compliance is non-negotiable. Accurate financial reporting helps businesses meet these obligations, avoiding costly fines, legal action, and reputational damage.

Financial control ensures that data is recorded in accordance with accounting standards, providing the audit trails necessary to prove compliance with external regulators.

What Does a Financial Controller Do?

A financial controller is a senior-level executive responsible for overseeing a business’s financial reporting and management. They act as the operator of the finance function. Their role has evolved from being a retrospective scorekeeper to a prospective business partner.

- Performance Analysis: By analyzing the variance between actual results and budgets, they identify operational strengths and weaknesses, providing deep-dive analytics into profitability.

- Current Status Assessment and Target Fulfillment: They are the navigator, monitoring the company’s current financial position and its progress towards set targets. They track KPIs like revenue growth and ROI, alerting the C-suite when the business drifts off course.

- Quality Assurance of Financial Information: They act as the gatekeepers of financial integrity, ensuring that all data generated is high-quality and reliable. This includes overseeing month-end closes and ensuring ledgers are balanced.

- Internal and External Support: They address the needs of stakeholders on all sides. Internally, they support managers with budget data. Externally, they are the primary liaison for auditors, tax authorities, and investors.

- Consolidation and Reporting: For complex businesses, these teams compile reports from different subsidiaries into a coherent financial overview. They eliminate inter-company transactions and ensure accurate currency translations.

- System Expertise: Controllers often serve as the business owners of the ERP system. They configure the system to enforce controls, capture necessary data, and integrate seamlessly with other business systems.

- Financial Statement Work: They meticulously prepare the balance sheet, income statement, and cash flow statement, ensuring these critical documents are compliant with accounting standards and ready for board presentation.

Types of Financial Controls with Examples

Financial controls are typically categorized by when they happen and what they are trying to achieve: Preventive, Detective, and Corrective. These categories are not mutually exclusive, but rather work together to form a robust internal control system.

Preventive controls (authorization, segregation of duties, security) stop errors before they happen. Detective controls (reconciliations, audits, reviews) find existing errors. Corrective controls (discipline, system fixes) fix issues and prevent recurrence. An effective financial control system uses all three types to manage risk.

Understanding the distinction is essential for building a defense-in-depth strategy, which involves layering controls to minimize risk exposure.

Preventive Controls

Preventive controls are proactive measures designed to stop errors or fraud before they occur. They are the first line of defense, building constraints into the system so that bad transactions simply cannot happen.

- Pre-Approval Requirements: This acts as a gateway. Management must verify or authorize an employee to perform a financial activity. For example, requiring a department head to approve any purchase order over $5,000 prevents unauthorized spending at the source.

- Access Controls and Authorization Limits: These act as locks and keys. They restrict access to physical assets, like cash in a safe, and virtual systems like accounting software. Authorization limits ensure a junior accountant cannot wire millions of dollars without the system blocking the transaction.

- Segregation of Duties (SoD): This is the concept of dividing critical tasks so no single person has unchecked power. For instance, the person who approves an invoice should never be the same person who processes the payment. This separation makes it difficult to embezzle funds without colluding with someone else.

Detective Controls

Detective controls are designed to find errors or problems after the transaction has occurred. They act as a safety net, identifying issues that manage to bypass preventive controls.

- Account Reconciliations: This involves comparing internal financial records with external documents to ensure accuracy. A classic example is the monthly bank reconciliation, where the cash ledger is checked against the bank statement to catch discrepancies like unrecorded fees or errors.

- Internal Audits: These are objective reviews meant to evaluate the system. An internal audit team might test a sample of expense reports to ensure they follow policy, detecting patterns of non-compliance. Furthermore, Internal audits and a structured financial audit process help management evaluate whether controls are operating as intended.

- Variance Analysis: This compares what was planned against what actually happened. If the travel budget was $10,000 but the actual spend was $20,000, variance analysis flags this anomaly for investigation.

Corrective Controls

Corrective controls are put into place to fix uncovered issues and prevent them from occurring again. Once a detective control identifies an error, the corrective control dictates the protocol for resolution.

- Error-Correction Procedures: Error-Correction Procedures define the specific steps teams take to rectify a detected error. These steps include posting a journal entry to adjust a balance and documenting the reason to maintain the audit trail.

- Policy Revisions: If a significant loss occurs, the business revises its policies to close the gap. For instance, if fraud was committed via corporate credit cards, a stricter card policy would be the corrective action.

- Training and Education: Often, errors stem from ignorance. Corrective controls include implementing training sessions to ensure staff understand how to follow procedures correctly in the future.

Financial Control Mechanisms

Specific, well-defined mechanisms build effective financial control. These mechanisms govern the overall financial business and, most critically, meticulously handle the business’s most liquid and vulnerable asset: cash.

These essential controls are not merely administrative formalities. Instead, they represent the foundational framework that ensures the integrity of a business’s financial reporting, safeguards assets from misuse or theft, and promotes operational efficiency.

Organization-Wide Governance

Organization-wide governance is a comprehensive framework comprising rules, processes, and structures like policies, protocols, and oversight mechanisms that guide and manage a business.

Its core purpose is to ensure accountability to stakeholders and progress toward strategic objectives. This system is crucial for establishing corporate culture, ensuring regulatory adherence, and enabling the efficient allocation and management of resources across the entire entity.

The scope of this governance extends across all hierarchical levels, from the Board of Directors to frontline staff. Effective governance also requires some key elements, like clearly defined goals, strong risk management, and a culture of transparency and long-term sustainability in all operations.

It ensures controls are integrated into the strategic fabric of the company, often using Governance, Risk, and Compliance (GRC) platforms for centralized policy management.

Cash-Inflow Controls

Cash-inflow controls focus on ensuring that the money coming into the business is managed correctly. This includes processes for accurately recording all incoming funds, depositing them promptly, and safeguarding against theft or fraud.

Key components of cash-inflow often involve segregating duties, using pre-numbered receipts, reconciling bank statements regularly, and establishing clear authorization levels for handling cash and checks.

- Credit Reporting Policy: Implementing stringent checks on customers before offering credit reduces the risk of bad debts.

- Periodic Review: Regularly reviewing existing customers ensures their continued creditworthiness.

- Reconciliation: Periodic reconciliation of bank statements to the general ledger ensures all incoming payments are recorded accurately, and nothing is skimmed.

Cash-Outflow Controls

Cash-outflow mechanisms ensure payments are authorized and legitimate, preventing fraud and unnecessary expenditure. This includes implementing a robust approval process for all disbursements, from vendor payments to employee reimbursements, and maintaining clear documentation for every transaction.

- Vendor Management: Maintaining a secure vendor database prevents payments to fictitious companies. Only authorized personnel may edit vendor details.

- Automated Payments: Monitoring subscription and automatic payments prevents “set and forget” waste.

- Reimbursement Policy: Clear policies requiring detailed receipts for expenses help curb employee fraud.

These cash‑outflow mechanisms work hand in hand with accurate inventory accounting to prevent stock shrinkage, such as loss from theft or damage. They protect profit margins by tracking and accounting for all stock movements.

Financial Controls Software and Technologies

In the digital age, sophisticated software and technology solutions increasingly mediate financial control. These technologies automate the complex “mechanics” of the financial control process, encompassing tasks like transaction recording, compliance monitoring, and reporting.

This automation significantly reduces the potential for human error in manual data entry and calculations, while simultaneously dramatically increasing the speed and efficiency of operations, providing real-time visibility into a business’s financial health.

Enterprise Resource Planning (ERP) Software

ERP software serves as the central nervous system for a business. It integrates and manages core business processes, such as finance, human resources, and supply chain operations, within a single, unified system. This integration provides a holistic view of the business, facilitating better decision-making and operational efficiency.

ERP systems improve financial control via three core capabilities: Centralization creates a “single source of truth” by eliminating data silos, Automation enforces critical controls, like preventing over-budget purchases, and seamless Integration instantly links business functions, ensuring actions like a CRM sale automatically trigger financial entries.

Governance, Risk, and Compliance (GRC) Software

GRC software is vital for organizational compliance, facilitating the mapping of internal controls to regulations like SOX. It provides a centralized platform for tracking real-time audit status, offering a clear overview of compliance across multiple frameworks.

Furthermore, GRC software manages the entire audit workflow, from planning to documenting findings and corrective actions. This centralization maintains a detailed audit trail, preventing oversight and significantly improving the efficiency and effectiveness of financial control and compliance.

Financial Planning and Analysis (FP&A) Software

FP&A software supports dynamic forecasting and detailed budgeting processes. It empowers finance teams to run complex “what-if” scenarios, model future financial performance with greater agility, and evaluate the impact of different strategic decisions.

Crucially, it integrates seamlessly with the company’s ERP system to leverage actual historical financial data, ensuring that all projections and models are based on the most accurate and up-to-date information possible.

Workflow Automation and Integration

Workflow tools replace manual, paper-based approval chains with digital ones. This means the system automatically routes documents, such as supplier invoices or expense reports, through the correct digital channels to the appropriate manager or department for review and approval.

This automated routing significantly reduces administrative friction and eliminates the time lost in physical document handling. Therefore speeds up overall cycle times for processes like accounts payable. Many businesses now rely on automated bank reconciliation to match bank statements with internal ledgers, allowing the system to update cash positions quickly and accurately each day.

Dashboards & Data Analytics

Modern control relies on visibility. Dashboards provide real-time views of KPIs like cash flow and variance. This allows for continuous monitoring, detecting anomalies as they happen rather than waiting for month-end reports.

However, all the software and technologies that have been mentioned can feel a bit overwhelming. Luckily, software like ScaleOcean accounting software provides an integrated solution that seamlessly connects those technologies.

By integrating with various systems, both internal and third-party, ScaleOcean optimizes financial control through a unified interface. Whether you need inventory tracking, automated accounting, or HR integration, ScaleOcean provides a single platform to manage it all.

Request a personalized demo to explore an accounting ERP solution tailored to your business and start optimizing your operations today. Contact us now to start customizing your success.

Best Practice Framework for Financial Control

To implement a truly effective financial control system, businesses should cling to a best-practice framework that balances rigor, ensuring compliance and accuracy, with agility, allowing the system to adapt to new business challenges and regulatory changes.

This balance is crucial because stringent controls are necessary to safeguard assets and ensure the integrity of financial reporting. But a system that is too rigid will quickly become obsolete or create bottlenecks that hinder business operations.

A modern financial control system, therefore, requires continuous monitoring and a commitment to integrating technology that supports both precise reporting and rapid, informed decision-making across the business.

Comprehensive Risk Assessment

The foundation is a deep understanding of risk. Businesses should conduct comprehensive assessments that identify financial, operational, and compliance risks. This must be dynamic, revisited whenever significant business changes occur.

This risk-centric approach requires establishing robust internal controls. The organization must design these controls, ranging from segregation of duties and approval hierarchies to automated system checks, to mitigate the identified risks effectively.

Regular monitoring and testing of these controls are essential. They are important to ensure their ongoing relevance and operating efficiency, adapting them as the risk landscape evolves.

Balanced Mix of Control Types

Over-reliance on one type of financial control leaves significant gaps in a business’s defense against risk. Best practice employs a balance of three core types: Preventive, Detective, and Corrective controls to form a continuous risk management cycle.

They form a crucial, closed-loop system for financial control. Preventive controls are the first defense, stopping errors before they occur. Detective controls identify risks that slipped past the preventive measures. Corrective controls, informed by detection, fix the issue, mitigate damage, and strengthen both preventive and detective systems for the future.

This integrated approach is not static. As a business environment evolves, so do its risks, eventually needing a periodic review of all control types to ensure their continued relevance and effectiveness.

Maintaining this cycle of prevention, detection, and correction is essential for sustaining a strong internal control environment and supporting long-term business stability.

Continuous Monitoring and Updates

Controls require continuous monitoring to ensure ongoing effectiveness. This involves the regular review of controls and their underlying processes. Furthermore, the controller must update controls promptly to reflect significant changes in the business environment, technology landscape, or regulatory requirements.

For example, staying level of emerging trends, such as governance frameworks for Artificial Intelligence (AI), is crucial for maintaining a robust control environment.

Staff Training & Competency Development

Controls are only as good as the people executing them. Best practice dictates investing in continuous training so everyone understands their role. They should also learn the importance of financial control and the potential consequences of non-compliance.

This includes detailed software training for any financial systems, regular compliance updates on regulatory changes such as Sarbanes-Oxley, IFRS, and mandatory ethics training to promote a culture of integrity and accountability. Well-trained staff are more likely to identify and report control weaknesses.

Leveraging Technology for Efficiency

Manual controls are inherently error-prone, time-consuming, and difficult to scale. The best practice of financial control involves strategically leveraging technology. For example, Enterprise Resource Planning (ERP) systems, specialized financial control software, and automation tools to execute controls.

The technology of automation now ensures consistency and reduces the risk of human error. It also provides a definitive audit trail and significantly speeds up the control execution and monitoring process. This shift frees up valuable human capital from routine verification tasks to focus on higher-value activities such as strategic analysis, risk assessment, and process improvement.

Perfect Financial Control Easily Using ScaleOcean Accounting Software

Achieving perfect financial control does not require a labyrinth of disjointed systems. ScaleOcean accounting software provides a comprehensive, all-in-one solution designed to optimize the management of financial controls through seamless integration.

ScaleOcean ensures your financial data is always synchronized, accurate, and actionable. By unifying accounting with sales, procurement, expense management, and HR, your accounting work will be the most efficient.

ScaleOcean distinguishes itself with customized features that adapt to your specific workflow, rather than forcing you to adapt to the software. With a user-friendly interface and support for unlimited users, it democratizes financial control across your business.

Security is always a principle, so ScaleOcean utilizes advanced encryption and robust access controls to safeguard sensitive data. ScaleOcean’s platform is designed to match current grant requirements (such as the CTC grant), ensuring your investment is financially efficient.

Below are the key features for Financial Control in ScaleOcean accounting Software:

- Automated Accounting: ScaleOcean automates transaction recording, eliminating human error. It generates reports aligned with local regulations, including PSAK & DJP formats, ensuring you are audit-ready.

- Real-Time Financial Reporting: Move beyond delays. ScaleOcean generates comprehensive financial statements and budget comparisons instantly, supporting the controller’s need for on-demand data.

- Auto Reconciliation: The system features automatic bank reconciliation, matching internal records with bank transactions to instantly detect discrepancies, automating a critical “Detective Control.”

- Approval Workflow: ScaleOcean offers a customizable hierarchy for approvals. You can configure exactly who has authority based on the nominal value and department. It is enforcing strict preventive controls and segregation of duties.

- Audit Logs: To ensure accountability, the system maintains detailed audit logs, recording who made changes, when, and the values before and after. This provides an immutable trail for auditors.

- Financial Statements and Budget Monitoring: ScaleOcean provides tools to visualize and track budget allocations, comparing actuals against budgets in real-time to allow proactive variance analysis.

In addition, ScaleOcean goes beyond the features mentioned above. By also providing a suite of specialized tools designed to tackle your various business challenges. For a direct understanding of the system’s advantages, a free demo is available. It allows you to experience the benefits firsthand before committing.

So, are you ready to move beyond disconnected spreadsheets and manual processes? Transform your financial and business management today with ScaleOcean.

Conclusion

Overall, Financial control is the discipline that transforms chaotic business activities into structured and profitable growth. From the small details of detecting overlaps to the strategic heights of forecasting and making projections. They protect assets, ensure accuracy, and foster an environment where businesses can meet strategic goals without fear of financial shocks.

This is a vital key to this ecosystem, orchestrating the people, processes, and technologies that make control possible. As we move through the mid-2020s, the integration of technology has become a priority. Specifically, ERP systems have become the defining characteristic of robust control.

By leveraging frameworks and powerful technologies like ScaleOcean accounting software, businesses can move beyond defensive conformity to absolute efficiency. If you’re serious about gaining a competitive advantage through superior financial control, try out ScaleOcean and get a free demo. In a world of uncertainty, a strongly built financial control system is the ultimate competitive advantage.

FAQ:

1. What skills are needed for financial control?

Key Skills for a Successful Financial Controller:

1. Strong grasp of corporate operations.

2. Proficiency in internal controls and compliance.

3. Full understanding of corporate transaction processes.

4. Emphasis on cost containment.

5. Uses analytics for better decision-making.

6. Drive business efficiency improvements.

2. What is the KPI for a financial controller?

Financial Key Performance Indicators (KPIs) are essential measures for assessing a business’s financial health. These metrics track outcomes such as profits, revenue, and expenses. Typically rooted in accounting data, financial KPIs are usually expressed as specific financial values or ratios, providing a crucial gauge of performance.

3. What is a key financial control?

A key financial control is defined as an action your department implements to identify errors or fraud within its financial statements. Departments are expected to have their processes and controls documented. Importantly, your department should already have these essential financial review and follow-up activities established.

4. What are common financial control mistakes?

Common financial control mistakes include mixing personal and business finances, overspending without a budget, and lacking emergency funds. Businesses often fail to budget, underestimate future costs, and make emotional rather than data-driven decisions. Failing to segregate duties also frequently opens the door to fraud.

PTE LTD..png)

.png)

.png)

.png)

.png)