Singapore’s business environment is dynamic and highly competitive, with companies constantly adapting to change. In such a fast-paced market, strong financial management systems, including ERP finance modules, are crucial for maintaining financial health, informed decision-making, and driving growth.

Whether a startup or an established company, having an effective system in place to manage financial data is critical for long-term success. According to Medium, the FinTech market in Singapore is valued at USD 7.8 billion and is expected to grow at a 7% CAGR in the coming years, highlighting the increasing need for advanced financial solutions.

ERP systems are critical for streamlining financial processes by providing firms with a single platform to manage accounting, financial reporting, and cash flow. ERP solutions automate and integrate financial processes, reducing human labor and improving accuracy.

This article will look at the essential features and benefits of an ERP finance module, as well as the factors to consider when choosing one, and how ScaleOcean’s accounting software may help your business’s financial management.

- The ERP finance module centralizes all financial data, integrating operations like general ledger, accounts payable/receivable, and reporting.

- Key features of the ERP finance module include Accounts payable management, risk control and regulatory compliance, asset lifecycle management, and more.

- Benefits of using an ERP finance module include better financial insight, improved operational efficiency, simplified regulatory compliance, and mitigation of financial risks.

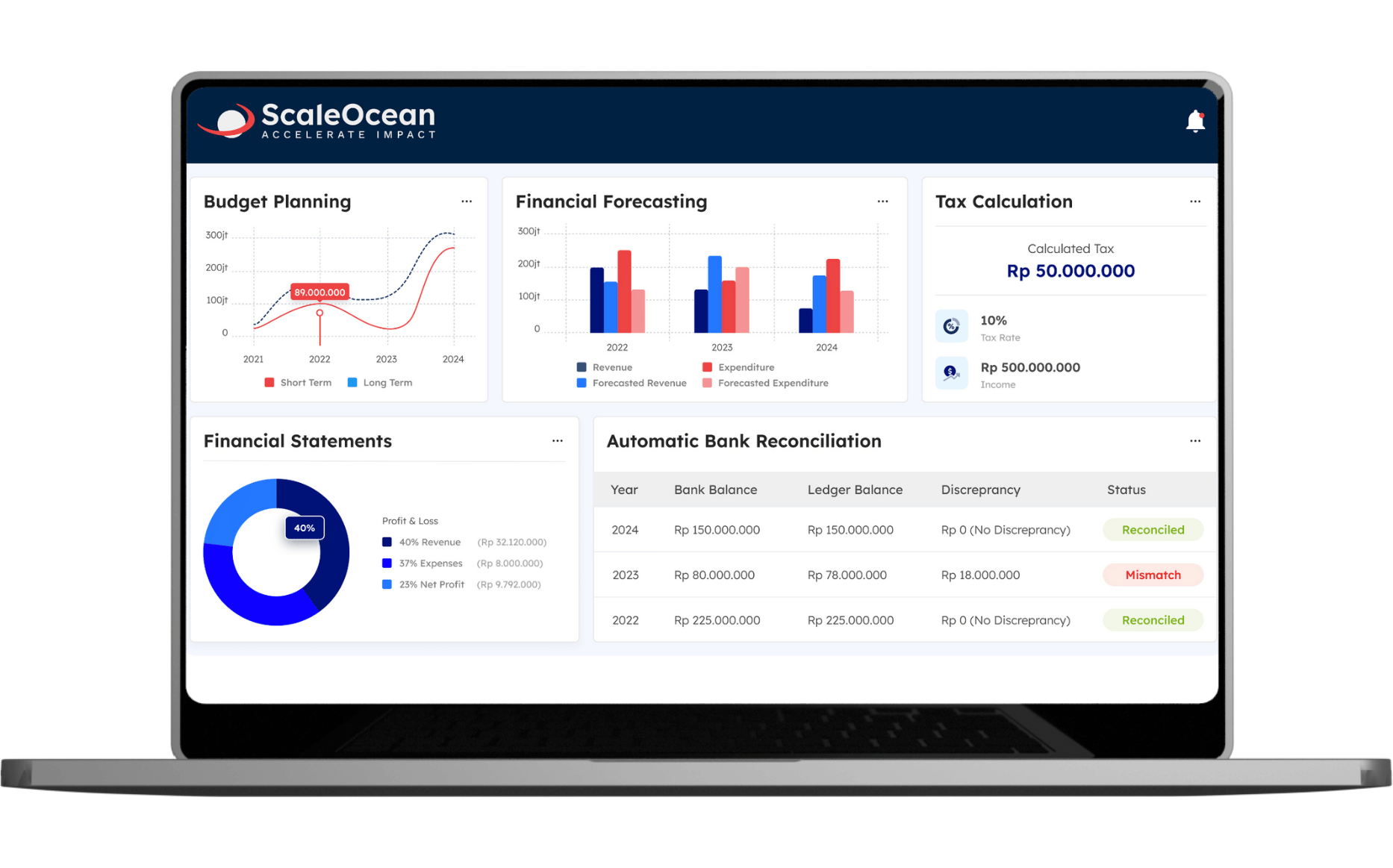

- ScaleOcean’s ERP finance module streamlines financial management by combining major financial functions and offering real-time reporting and analytics to aid strategic decision-making.

Understanding the ERP Finance Module

The ERP finance module centralizes all financial data, integrating operations like general ledger, accounts payable/receivable, and reporting. This unified system enables businesses to track transactions in real time, ensuring accurate reports, compliance, and streamlined financial operations.

One of the core functions of the ERP finance module is managing accounting and financial reporting. It ensures real-time visibility of financial data, allowing companies to track expenses and revenue efficiently. Bank reconciliation is also a vital aspect, ensuring smooth financial operations.

The general ledger serves as the backbone of the system, capturing all financial transactions. Accounts payable and accounts receivable modules handle supplier commitments and incoming payments. Financial reporting enables timely and accurate financial accounts for better decision-making.

Key Features of ERP Finance Module

The ERP finance module is crucial for simplifying and centralizing financial operations. It brings together accounting, cash flow, and reporting for highly accurate data handling. For companies seeking the best financial ERP software in Singapore, this module is key to maximizing performance. Key features include:

1. Risk Control and Regulatory Compliance

Risk management within your ERP system is crucial for monitoring and controlling access and activities. By allowing role-based access rules, it reduces unauthorized access and keeps sensitive financial data safe. Preventing ERP system failures involves ensuring strong security measures like this.

The ERP finance module also automates workflows to meet key compliance mandates like Sarbanes-Oxley. This step ensures your financial processes align perfectly with industry standards, resulting in stronger internal controls and audit readiness.

2. Accounts Payable Management

Accounts payable tracks the short-term debts your organization owes its vendors and suppliers. This system is crucial because it ensures timely payments, which helps avoid late fees and strengthens those vital vendor relationships needed for smooth business operations.

Inside an ERP finance module, accounts payable automatically integrates supplier data with invoice processing. This automation drastically cuts errors and improves overall efficiency, guaranteeing payments are made accurately and promptly while protecting your cash flow.

3. Financial Planning and Budgeting

Financial planning and budgeting are vital for long-term success. ERP systems provide businesses with forecasting tools to predict future revenue and expenses, enabling proactive planning for financial health. Understanding the right ERP software is key to effectively utilizing these tools for better financial management.

These tools enable management to quickly adjust strategies based on real-time financial data. With reports that are highly accurate, financial planning becomes much more precise, helping companies make informed decisions that support lasting profitability and growth.

4. Asset Lifecycle Management

Asset lifecycle management helps businesses monitor and strategically handle their physical and intangible assets. This process covers the entire lifespan, from purchase through depreciation and final retirement, ensuring assets are utilized as efficiently as possible.

An ERP finance module automates this whole process, making asset tracking much simpler. The system is designed to help businesses manage capital spending and intellectual property, ensuring proper accounting and optimizing asset value across their full lifecycle.

5. Vendor Relationship Oversight

Integrating vendor management within your ERP system simplifies interactions with suppliers. It allows you to monitor their performance, ensuring they meet compliance standards and service-level agreements. The benefit of ERP consolidation is seen in streamlined vendor oversight across multiple systems.

The system handles supplier terms and conditions, making contract management, renewals, and terminations straightforward. This integrated view lets organizations make data-driven choices, maintain strong supplier relationships, and negotiate better deals.

6. Accounts Receivable Management

Accounts receivable tracks all money owed to your company by customers, helping businesses stay on top of incoming payments. Efficient collections give a boost to cash flow. The strategy of two-tier ERP can further enhance this by integrating local and corporate financial processes seamlessly.

In an ERP finance module, accounts receivable fully automates invoicing and payment processes. This dramatically cuts down on manual errors and time spent on tasks, leading to better cash management and higher overall productivity for your finance team.

7. Multicurrency Transactions Handling

For businesses trading globally, handling multiple currencies is a daily requirement. The ERP system makes this much easier by consolidating all transactions, giving you a clear financial picture displayed in your preferred base currency.

ERP finance modules integrate real-time exchange rates to properly account for currency fluctuations. This ensures you get accurate financial insights, even across multiple countries, helping your business stay compliant and well-informed.

8. Cash Flow and Liquidity Management

Managing cash flow and liquidity inside your ERP system lets you monitor and control finances effectively. You get a real-time view of all cash inflows and outflows, which is essential for ensuring you’re using your resources in the best way possible. Effective expense management is key to this process.

The system also helps you predict future cash needs, allowing you to plan for big expenses and avoid unexpected liquidity problems. By securing financial health, you can make sure resources are allocated much more efficiently across the business.

9. Tax Compliance and Reporting

Tax management within an ERP system is key to keeping your company compliant with local and global tax laws. It tracks obligations and automates reporting tasks to simplify filing, reducing the risk of penalties. Understanding hybrid ERP helps in leveraging its flexibility for tax compliance across different platforms.

This feature is especially useful for businesses operating across multiple regions as it helps manage diverse tax rates and rules effortlessly. Regular updates ensure your organization stays current with the latest regulations, making tax compliance much smoother.

10. Bank Account Integration and Management

Bank account integration connects your company’s accounts right into the ERP system. This simple step lets you track balances, view transaction histories, and transfer funds efficiently. It is a real game-changer for day-to-day financial operations.

This feature is crucial for supporting bank reconciliation, ensuring your financial statements are always accurate and current. With integrated banking management, you can quickly resolve discrepancies, making your financial data reliable and completely transparent.

11. Profitability Analysis

Profit tracking inside your ERP system helps gauge the overall health of your finances. It breaks down performance by product or service, giving insight into each part’s contribution to your bottom line. Understanding the function of SaaS ERP enhances these capabilities with cloud-based flexibility.

By closely tracking profitability across all operations, companies can easily spot areas needing improvement. This detailed analysis guides decision-making, allowing you to focus resources on the most profitable activities and streamline anything less productive.

12. Transaction Reporting and Analytics

Transaction reporting and analytics give you valuable insights into your financial health. ERP systems produce detailed reports that directly support data-driven decision-making, helping businesses fine-tune and optimize their financial strategies effectively.

This reporting capability helps leadership grasp key performance metrics. With real-time data access, management can make smart, informed decisions that drive profitable growth, keep costs low, and boost the overall efficiency of the business.

13. General Ledger Functionality

The general ledger is essential for tracking every financial transaction in your organization. It records sales, expenses, inventory, and cash flow, providing a reliable snapshot of your business’s financial situation. The function of a mobile ERP system enhances this by offering real-time access to financial data.

An ERP system utilizes the general ledger to create accurate financial statements. This is possible because all your data is consolidated in one place, which significantly improves reporting accuracy, making it much easier to monitor your financial health and ensure compliance.

Benefits of Implementing an ERP Finance Module

Implementing an ERP finance module offers businesses a wide range of benefits, all of which contribute to better financial management and streamlined operations. By centralizing financial data and automating key processes, businesses can improve their financial oversight, reduce risks, and operate more efficiently.

According to VisitSingapore, Singapore is Asia’s leading fintech hub, with over 1,000 fintech firms based in the country, underscoring the growing demand for efficient financial systems like ERP solutions to support business growth and innovation. Below are some of the key advantages of adopting an ERP finance module for your business:

1. Enhanced Financial Visibility

Implementing a finance module in ERP gives firms real-time access to financial data, which improves decision-making. This visibility enables managers to evaluate financial performance and make informed decisions based on current information. Furthermore, transparency in financial reporting minimizes the likelihood of errors and fraudulent activity.

2. Operational Efficiency

Routine financial processes, such as invoice vs receipt processing and financial reconciliation, can be automated to reduce the likelihood of human error while also saving time. By reducing these processes, firms may focus on more critical duties, resulting in increased overall efficiency and cost savings. Businesses can optimize operational workflows by implementing a well-integrated ERP finance and accounting module.

3. Regulatory Compliance

The ERP finance module enables firms to comply with local and international financial standards. Financial data organization streamlines the financial audit process and guarantees compliance with accounting rules. The built-in tools for financial reporting and data management make compliance simpler and more efficient.

4. Mitigate Financial Risks

Using an ERP finance module helps minimize financial risks by automating tasks and centralizing data. With real-time visibility, businesses can spot issues early, reduce errors, and improve accuracy in financial reporting. A cloud-based ERP further enhances this by offering easy access and scalability.

Considerations for Selecting an ERP Finance Module

Choosing the right ERP finance module is a critical decision that will directly impact your long-term operations. When evaluating solutions, you need to examine numerous significant factors to ensure the module truly meets both your current and future business needs. Here are the essential factors to consider as you make your decision:

1. Scalability

When selecting an ERP financial module, scalability is a vital consideration. As your business expands, so will its financial management requirements. It is critical to choose a system that can scale to meet the growing size and complexity of your operations.

A scalable ERP system is designed to grow with you, allowing the business to adapt easily when financial needs shift. This ensures your system remains highly effective and efficient in consistently meeting evolving demands. Choosing the best custom enterprise software enhances this adaptability.

2. Integration Capabilities

An ERP finance module should work seamlessly with your existing financial systems and other modules in your ERP suite. This compatibility is critical for avoiding disruptions to your business operations and guaranteeing a seamless data movement.

By choosing a system that integrates well with your existing infrastructure, you can reduce data silos. This leads to improved departmental efficiency and more accurate, accessible financial data, including smooth integration with ERP banking systems for better financial management.

3. User-Friendliness

The simplicity of use in an ERP finance module is essential. A user-friendly design helps finance teams navigate the system easily, reducing the learning curve and eliminating lengthy training. Understanding custom ERP and off-the-shelf ERP ensures choosing the right system for ease of use.

Look for solutions that are simple and require little effort to use. Evaluate the availability of ongoing training and support to help your staff fully utilize the system and optimize its potential.

Simplify Financial Management with ScaleOcean’s Accounting Software

ScaleOcean is a reputable ERP choice for Singaporean companies. Its finance module simplifies management by integrating key activities like the general ledger, accounts (A/P, A/R), and cash management into one cohesive system, truly streamlining operations.

This software gives businesses real-time financial reporting and analytics, offering deep insights for better strategic decision-making. With improved control, the system easily adapts to changing financial needs and integrates smoothly with existing setups.

ScaleOcean’s intuitive interface, plus dedicated support and training, helps businesses truly optimize their financial tasks. This solution is eligible for the CTC grant, and you can get a free demo to see firsthand how it improves financial management. The following are ScaleOcean’s key features:

- IFRS Compliant: ScaleOcean’s accounting software is fully aligned with IFRS (International Financial Reporting Standards), ensuring that your financial reporting is compliant with global accounting standards.

- All-in-One Solution: ScaleOcean’s accounting software offers an all-in-one solution with over 200+ specialized modules and 1,000+ feature options.

- Industry Best Practices: ScaleOcean’s accounting software is designed based on the best industry practices and solutions, tailored specifically to solve the unique challenges faced by businesses today.

- Customizable Solutions: ScaleOcean provides advanced customization options, allowing you to tailor its accounting software to fit the specific needs of your company.

Conclusion

A strong ERP finance module helps firms achieve financial excellence by offering real-time data, seamless automation, and comprehensive reporting tools. These features enable firms to streamline their financial operations, make better decisions, and comply with regulations. With the correct financial management system in place, businesses can successfully manage cash flow, utilize resources, and scale operations efficiently.

If you want to improve your financial operations and promote business success, ScaleOcean’s accounting software is the solution for you. ScaleOcean streamlines finance administration and promotes business growth by providing comprehensive features geared to your specific needs. To fully realize its potential, we welcome you to try ScaleOcean’s free demo today and learn how it may improve your financial processes.

FAQ:

1. What is the ERP finance module?

The ERP finance module is a critical component of an ERP system, designed to manage all financial activities. It facilitates transaction management, cash flow tracking, and the automation of numerous financial duties, resulting in smooth financial operations.

2. What is a module in finance?

In finance, a module is a specialized tool or capability within a financial management system, such as the general ledger or accounts payable, that manages certain financial activities within the firm.

3. What are SAP finance modules?

SAP finance modules are specialized components of the SAP ERP system that serve critical financial operations such as financial accounting, reporting, and control, allowing organizations to manage their finances more efficiently.

4. What is financial accounting in ERP?

Financial accounting in ERP refers to the systematic recording and reporting of financial transactions within the system. It assures reliable financial data and contributes to compliance while giving organizations real-time financial visibility.

PTE LTD..png)

.png)

.png)

.png)

.png)