Depreciation is an important tool in financial management because it allows organizations to spread the expense of assets over their useful lives. It ensures that expenses are documented in a way that reflects the actual wear and tear on assets, giving a more accurate picture of a company’s financial situation. This procedure assists organizations in not overestimating their asset prices.

Depreciation is essential for businesses to report accurately and comply with tax regulations. It ensures that companies follow accounting standards while maximizing tax deductions. Effective asset management fosters sound financial practices, enabling businesses to make informed decisions about long-term planning and growth.

- Depreciation allocates the cost of a fixed asset over its useful life, reflecting its gradual loss of value due to use or obsolescence.

- Methods like straight-line, declining balance, and units of production allocate an asset’s cost based on usage or obsolescence.

- Depreciation is calculated by identifying the asset’s cost, salvage value, and useful life. After selecting the most appropriate method, businesses can apply formulas like straight-line or double declining balance to determine annual depreciation accurately.

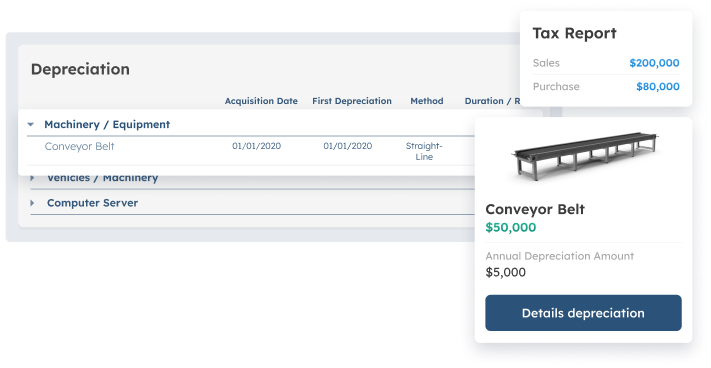

- ScaleOcean’s accounting software automates depreciation calculations, reducing manual work and ensuring real-time accuracy. This integration simplifies financial reporting and improves decision-making by streamlining complex depreciation schedules.

What Is Depreciation?

Depreciation is an accounting strategy for spreading the expense of a fixed asset over its useful life. Simply said, it illustrates how an object gradually loses value as a result of constant use, natural wear and tear, or becoming outmoded. For businesses, this idea is critical in accurately displaying the asset’s true value over time.

Companies use depreciation accounting to track how the value of assets such as machinery, vehicles, and computers decreases with each year of use. This guarantees that financial reports provide a fair and accurate representation of the company’s assets. For businesses looking to optimize their capex (capital expenditures), proper depreciation management is essential for tracking the financial impact of asset usage.

How Depreciation Works in Accounting

Depreciation enables firms to adhere to the matching principle in accounting. This approach ensures that the cost of using an asset is recorded at the same time in which the asset generates revenue. Without it, financial statements would reflect assets at their original cost, which may no longer be relevant.

This process affects both the balance sheet and the income statement. On the balance sheet, the asset’s book value decreases with time. The expense is recorded on the income statement, reducing the company’s reported profit. Businesses must follow the Singapore Accounting Standard to ensure compliance with local regulations, ensuring their depreciation practices are in line with financial reporting requirements.

Why Do Depreciation Calculations Matter for Your Business?

Depreciation is a critical tool for firms to manage the financial impact of asset utilization over time. Companies can improve the accuracy of their financial reports by designating a percentage of the cost of an asset as an expense each year. Understanding the causes for asset value reduction can help you make better decisions, particularly in capital budgeting, tax planning, and capital investments. The following are the main reasons businesses use depreciation:

1. Tax Deductions

Businesses that record depreciation as an expense reduce their taxable income, lowering their tax liability. This allows businesses to keep more of their money, which may then be spent in operations or expansion activities. The reduction in asset cost over time helps businesses avoid paying higher taxes, thereby contributing to healthier profitability ratios.

2. Reflecting True Asset Value

Depreciation ensures that the asset’s balance-sheet value corresponds more closely to its actual value. Instead of reflecting the initial purchase price, it indicates the value loss due to use or obsolescence. This more precise asset valuation enables organizations to make better financial decisions by ensuring they do not overestimate their resources.

3. Supporting Decisions

Depreciation provides useful information for making judgments about asset replacement or future capital expenditure. Understanding the real-time worth of assets enables firms to plan when to replace or enhance them. This helps to guarantee that investments are made properly, based on the asset’s current usefulness and remaining lifespan, while considering the application of absorption costing in total cost management.

Types of Depreciation Methods

Depreciation methods help firms determine how to allocate an asset’s cost over its useful life. Each strategy differs based on how the asset is used or its rate of obsolescence. Understanding the various types of allocation can help businesses select the best option for their specific needs. The following are the primary methods of depreciation:

1. Straight-Line Depreciation

This method equitably distributes depreciation expenses over the asset’s useful life. It’s simple and suitable for long-term assets that progressively lose value, like office furniture or buildings. The calculation is simple, keeping yearly spending manageable and predictable. Most firms employ this strategy since it is simple and consistent.

2. Declining Balance Depreciation

In this strategy, depreciation costs are higher in the early years and decrease over time. This is appropriate for items that depreciate rapidly, such as autos or electronics. The method represents the increased expense early on, when the asset’s value declines more rapidly. As a result, it helps to align the expense with the asset’s utilization.

3. Double Declining Balance

An accelerated approach in which the rate is double that of the straight-line method. It results in higher depreciation costs in the asset’s early years but lower ones later on. This strategy is typically used for swiftly depreciating assets such as machinery or computers. It enables firms to claim higher deductions initially, resulting in tax savings.

4. Sum-of-the-Years’ Digits

This method calculates depreciation as a weighted proportion of the asset’s useful life. The proportion falls each year, demonstrating the asset’s declining productivity over time. It is especially valuable for assets that are very efficient in their early stages of operation, such as specialized equipment. This method takes a more thorough and dynamic approach to asset value reduction.

5. Units of Production

Depreciation in this method is calculated based on the asset’s actual usage, such as machine hours or units produced. It is perfect for manufacturing companies where the wear and tear on machinery is directly related to its usage. This strategy assures that the expense corresponds to the actual degree of asset usage, resulting in a more realistic portrayal of costs.

How to Calculate Depreciation: Step-by-Step

Calculating depreciation is an important aspect of financial accounting since it ensures that an asset’s cost is dispersed over its useful life. Understanding the process allows organizations to appropriately reflect the value of their assets over time. Here’s a step-by-step instruction for calculating depreciation:

1. Identify the asset’s cost, salvage value, and useful life

The first stage is to calculate the asset’s initial cost, which includes all expenses associated with the acquisition. Then, estimate the salvage value, which is the amount you anticipate the item will be worth at the end of its useful life. Finally, determine the asset’s useful life, which is the number of years it is expected to be in service. This information is critical for performing proper depreciation estimates.

2. Select the most suitable depreciation method

After gathering the necessary information, select a method that is appropriate for how the asset is utilized or loses value over time. Depending on the asset type and usage, straight-line or declining balance depreciation are popular options. Choosing the appropriate technique ensures a fair allocation of the asset’s cost during its life cycle, making financial reporting more accurate and helpful.

3. Use the Depreciation Formula for Accurate Calculation

To calculate depreciation accurately, use the correct formula that corresponds to your chosen method. Each calculation contributes to determining how much expense should be allocated over the asset’s useful life. Here are the formulas for three commonly used methods:

a. Straight-Line Formula

The straight-line depreciation formula is the simplest way, allocating the asset’s cost evenly across its useful life. It enables enterprises to recognize an equivalent expense each year. This technique is ideal for assets that lose value on a consistent basis. The formula goes as follows:

(Asset Cost – Salvage Value) / Useful Life

b. Double Declining Balance Formula

This method estimates asset value reduction more quickly in the first years of an asset’s life, making it appropriate for items that lose value quickly. The straight-line method’s rate is doubled to represent accelerated asset value reduction. This is how the formula works:

(Book Value at Beginning of Year) × (2 / Useful Life)

c. Units of Production Formula

This strategy is excellent for assets whose value diminishes with usage rather than time. It takes into account the asset’s entire output as well as depreciation based on how much it is used over a given time period. Here’s the formula for this method:

(Asset Cost – Salvage Value) / Total Units Estimated × Units Used in Period

Practical Examples of Depreciation Calculations

To better understand how depreciation works in real-world circumstances, consider a few instances utilizing various methodologies. These practical examples will show how asset value reduction is computed for numerous asset kinds, including office equipment, automobiles, and machinery. Here are three common methodologies and their respective calculations:

1. Example 1: Straight-Line Depreciation on Office Equipment

Assume a corporation purchases office equipment for SGD 10,000. The anticipated salvage value at the end of the asset’s life is SGD 1,000, with a useful life of 5 years. Each year, the corporation will distribute depreciation evenly over the useful life. This strategy is straightforward and efficient for assets such as office furniture. The formula goes as follows:

(10,000 – 1,000) / 5 = 1,800 per year

2. Example 2: Double Declining Balance on a Vehicle

A corporation buys a vehicle for SGD 20,000 with no salvage value and expects it to remain serviceable for five years. The first year’s expense is higher due to the accelerated technique. Using the double declining balance method, the corporation will record higher costs in previous years. This is how the formula works:

Year 1: 20,000 × (2 / 5) = 8,000

Year 2: (20,000 – 8,000) × (2 / 5) = 4,800

3. Example 3: Units of Production on Machinery

Consider a corporation that purchases machinery for SGD 50,000 with a salvage value of SGD 5,000. The machinery is expected to produce a total of 100,000 units during its lifetime. In its first year, it produced 10,000 units. Depreciation in this system is based on actual utilization of the machinery rather than time. The formula goes as follows:

(50,000 – 5,000) / 100,000 × 10,000 = 4,500

Who Determines Depreciation Policies?

Typically, a company’s accounting and finance teams decide depreciation rules. These teams are in charge of determining the best method based on the nature of the assets and the company’s financial requirements. Their purpose is to make sure that the reduction in asset value is properly recognized in the financial statements.

These rules must be consistent with accounting standards such as IFRS and SFRS, which are commonly utilized in Singapore. Following these standards ensures that financial reporting is consistent, accurate, and fair, allowing firms to maintain their credibility and transparency. Financial audit is an essential process to verify that companies are in compliance with these standards and to ensure proper depreciation practices are followed.

Key Considerations When Applying Depreciation

When using depreciation, organizations must verify that their operations are compliant with applicable standards and provide accurate financial reporting. This contributes to the integrity of financial statements and ensures effective asset management, which can be further streamlined with asset management software. Here are significant considerations to consider when applying depreciation:

1. Aligning with Accounting Standards

Depreciation should be estimated using accounting standards such as IFRS and SFRS. These standards establish criteria for determining the appropriate method and ensuring compliance with financial reporting rules. For businesses to efficiently manage depreciation and comply with these standards, an effective accounting system for business is essential, as it ensures accuracy in financial reporting and seamless tracking of asset values.

2. Consistency and Transparency in Financial Reporting

Consistency is essential when using depreciation methods to ensure accurate comparisons over time. Transparency in the process enables stakeholders to understand the company’s financial health. This involves fully describing the chosen techniques and assumptions, which enables reliable decision-making.

3. Review and Adjustment When Asset Usage or Value Changes

Over time, an asset’s usage or value may change, requiring a reassessment of its depreciation. Businesses should adjust their calculations to reflect the asset’s true value. According to IRAS, capital allowances are no longer granted for expenditure funded by capital grants from the Government or Statutory Boards approved after Budget 2020, effective January 1, 2021. Businesses must adjust their depreciation methods to comply with these changes.

Common Mistakes to Avoid in Depreciation

Depreciation is an important part of financial reporting, but mistakes in the process can result in misleading financial statements and tax issues. Businesses may avoid typical errors and ensure that their asset value allocation policies are correct and effective. Here are the pitfalls to avoid when applying depreciation:

1. Incorrect Estimation of Useful Life

One common error is underestimating the usable life of an asset. If the asset is predicted to last longer or shorter than planned, this will alter the annual depreciation expense. Businesses should base their estimates on realistic considerations such as asset condition and industry benchmarks.

2. Neglecting to Reassess Salvage Value

Failure to review the salvage value might lead to an asset being overestimated or underestimated at the end of its useful life. The salvage value should be reviewed on a regular basis to ensure that it reflects changes in market conditions or asset condition, allowing for more accurate depreciation.

3. Applying the Wrong Method for Asset Type

Choosing the wrong depreciation method can lead to inaccurate financial outcomes. For instance, using straight-line depreciation for assets that quickly lose value, like vehicles, may misrepresent their actual usage. According to SSO, the Minister may make regulations under the Financial Procedure Act 1966, effective 19 Jul 2025, to manage public money. Non-compliance could cause significant financial reporting errors.

Simplifying Depreciation Management with ScaleOcean Accounting Software

ScaleOcean’s asset management software automates and streamlines depreciation management, making it easier for organizations to manage complex depreciation schedules. The program reduces manual work, decreases errors, and assures that depreciation expenditures are calculated correctly. Businesses that automate this procedure can save time and enhance financial reporting, resulting in better decision-making and operational efficiency.

ScaleOcean allows you to ensure compliance with Singapore accounting rules as well as smooth interaction with fixed asset management. The program is designed to comply with local standards, giving firms confidence in their financial operations. Furthermore, ScaleOcean provides a free demo for enterprises to test the platform’s full capabilities, with the added benefit of being eligible for the CTC grant. The following are the main features of ScaleOcean software:

- Automated Depreciation Calculation, ScaleOcean automates depreciation, reducing manual errors and ensuring accurate and consistent financial reporting.

- Seamless Asset Management Integration, Integrates with asset management for real-time tracking of asset value and depreciation, improving accuracy and saving time.

- Real-Time Financial Insights, Provides real-time updates on depreciation, enhancing decision-making and financial analysis.

- Local Compliance & Reporting, Ensures compliance with local accounting standards, reducing manual work during audits and tax filings.

- Customizable Depreciation Schedules, Offers flexible depreciation schedules tailored to specific assets or regulations, ensuring accuracy in financial records.

Conclusion

Understanding and properly administering depreciation is critical for accurate financial reporting and decision-making. It guarantees that firms accurately display the value of their assets and adhere to accounting requirements. Without effective management, businesses risk overestimating their asset values, resulting in misleading financial statements.

Using technologies like ScaleOcean can help to simplify the depreciation process by automating calculations and assuring compliance with local rules. Businesses can use its integrated capabilities to streamline their financial procedures, decrease manual errors, and increase overall accuracy. ScaleOcean provides a powerful solution that improves financial transparency and efficiency, allowing businesses to focus on development and profitability.

FAQ:

1. What do you mean by depreciation?

Depreciation refers to the method of allocating the cost of an asset over its expected lifespan. It represents the reduction in value of an asset due to regular usage, wear, and obsolescence. This process ensures that the asset’s value is accurately reflected in the financial records as it is utilized over time.

2. How is depreciation calculated?

1. Determine the asset’s cost – Identify the total cost of the asset, including its purchase price, taxes, and installation.

2. Estimate the useful life – Determine how long the asset will be used in the business.

3. Estimate the salvage value – Predict the amount the asset will be worth when it’s no longer useful.

4. Choose a depreciation method – Decide on a depreciation method, such as:

• Straight-line (depreciates evenly over time)

• Declining balance (higher expense in earlier years)

• Units of production (depends on usage)

5. Apply the formula – Use the relevant formula for the chosen method to calculate annual depreciation.

3. What is an example of depreciation?

For instance, if a company buys machinery for $10,000, with a 5-year useful life and a salvage value of $1,000, they would use straight-line depreciation to allocate $1,800 per year. The machinery’s value decreases by this amount annually, and it is recorded in the financial statements as an expense.

4. Is depreciation an expense or income?

Depreciation is considered an expense rather than income. It reduces a company’s taxable income by spreading the asset’s cost over its useful life. As a non-cash charge, it helps reflect a more accurate profit by adjusting the value of assets as they lose worth over time.

PTE LTD..png)

.png)

.png)

.png)

.png)