Profitability ratios are important financial measures that help businesses evaluate their capacity to create profits from operations. These ratios provide information on how efficiently a company converts sales into earnings, allowing businesses to assess their financial health. In today’s competitive business environment, particularly in Singapore’s quickly rising economy, understanding profitability is critical for long-term success.

Profitability ratios are useful tools for business owners, CFOs, and financial managers to monitor financial performance and make sound decisions. These ratios not only show how successfully a company controls its revenue and spending, but they also help with operational optimization, cost control, and future growth planning.

- Profitability ratios are financial metrics that measure a company’s ability to generate profits from sales, helping businesses evaluate their efficiency in converting revenue into profit.

- Key profitability ratios like Gross Profit Margin, Operating Profit Margin, Net Profit Margin, Return on Assets (ROA), and Return on Equity (ROE) provide valuable insights into a company’s financial health and growth potential.

- To improve profitability ratios, businesses can focus on cost-cutting measures, optimizing pricing strategies, enhancing operational efficiency, and conducting regular reviews to identify improvement opportunities.

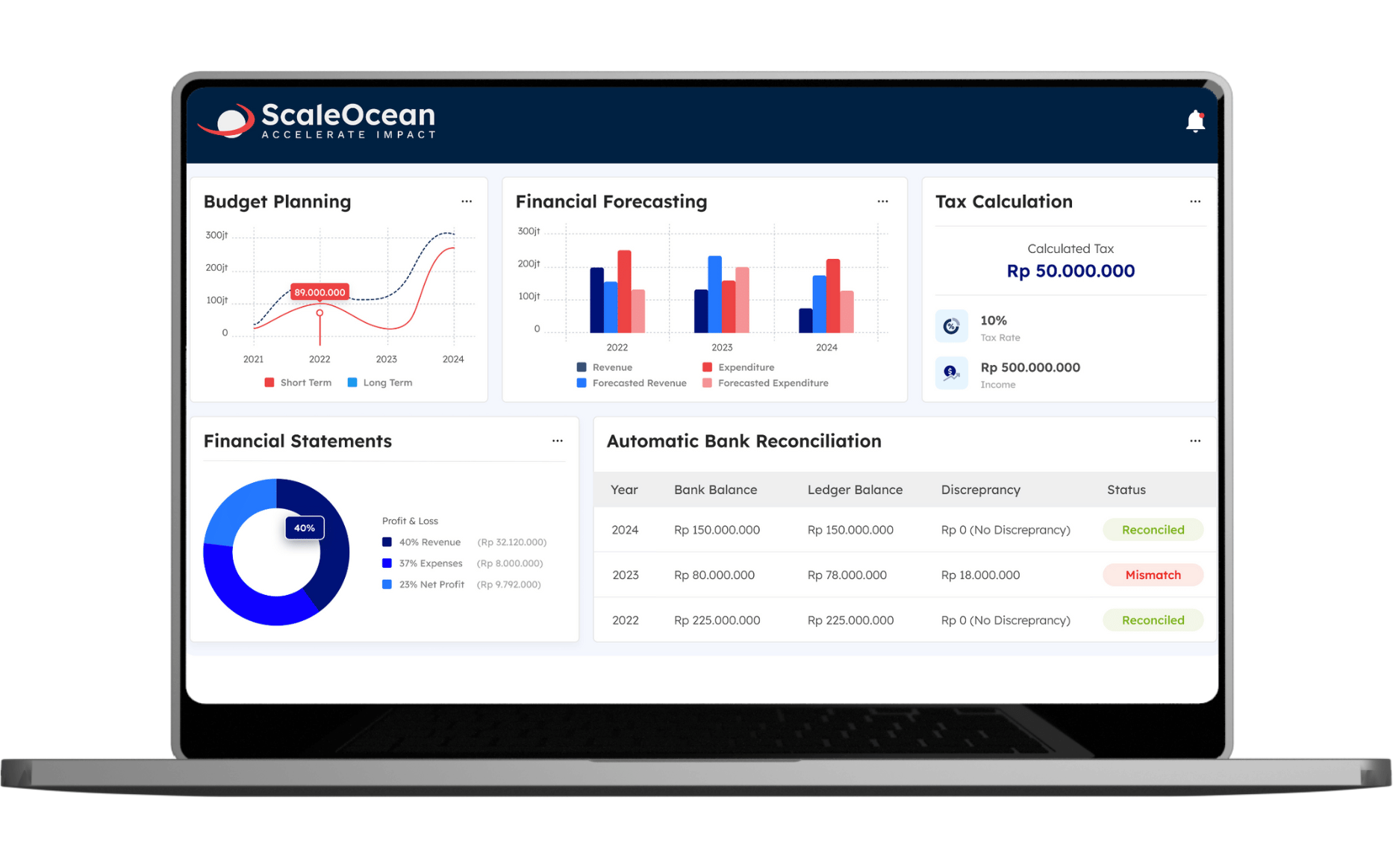

- Accounting software like ScaleOcean automates the calculation and analysis of profitability ratios, providing real-time financial insights and streamlining financial management for better decision-making.

What Are Profitability Ratios?

Profitability ratios are financial measurements that assess a company’s capacity to create profits from its sales. These ratios are critical for determining how efficiently a company transforms its sales into profits. By studying profitability ratios, firms can assess their competitive advantage and find opportunities for improvement.

These ratios provide investors, stakeholders, and management with vital insights into a company’s financial health. They play an important role in decision-making by assessing operational efficiency and long-term financial stability. Monitoring profitability ratios is critical to optimizing plans and ensuring a company’s long-term growth.

Key Profitability Ratios Every Business Should Know

Profitability ratios are critical metrics for evaluating a company’s financial performance. By studying these ratios, firms can acquire significant insights into their revenue generation capabilities and expense management effectiveness. These ratios are also useful in analyzing a company’s financial health and potential for long-term growth. Understanding these ratios is critical for making sound judgments that can lead to corporate success. The following are the key profitability ratios that any business should understand:

1. Gross Profit Margin

The gross profit margin measures the percentage of revenue left after subtracting the cost of goods sold (COGS). It is calculated using the profit margin formula, which is:

Gross Profit Margin = Gross Profit / Revenue × 100

This ratio indicates how efficiently a company produces its goods or services at a profit. A higher gross profit margin signifies that a company is managing its production or service costs effectively, allowing the company to retain more revenue as profit. It’s a key indicator of operational efficiency and a company’s ability to generate profits from its core activities before accounting for other expenses.

2. Operating Profit Margin

The operating margin shows a company’s ability to generate profit from its core operations, excluding non-operating income and expenses. It is calculated as:

Operating Profit Margin = Operating Income / Revenue × 100

This ratio demonstrates a company’s operational efficiency by accounting for both direct and indirect operating costs. A larger operating profit margin indicates that the company is effectively managing its costs and efficiently transforming sales into profit.

It is a reliable indicator of how successfully a firm manages its day-to-day operations and can represent the strength of its competitive position.

Additionally, monitoring accounts receivable can provide further insights into how well the company is managing its collections and cash flow, ensuring that sales are effectively converted into cash and supporting the operating profit margin.

3. Net Profit Margin

The net profit margin reveals the percentage of revenue remaining after all expenses, including taxes and interest, have been deducted. It is calculated as:

Net Profit Margin = Net Income / Revenue × 100

This ratio is critical in measuring overall profitability and the percentage of a company’s revenue transformed into actual profit. A larger net profit margin indicates effective financial management and the ability to maintain profitability even after all operational and non-operational costs consider the business. It is a critical indicator of a company’s financial health and ability to make profits.

4. Return on Assets (ROA)

ROA measures how effectively a company uses its assets to generate profit. It is calculated as:

Return on Assets = Net Income / Total Assets

A greater ROA implies that a corporation is making good use of its assets to create profits. This ratio is especially relevant in asset-heavy industries since it assesses how successfully a company uses its large investments in assets to create value. ROA is an excellent indicator of how effectively management utilizes the company’s resources to generate earnings.

5. Return on Equity (ROE)

ROE measures how well a company generates profit using its shareholders’ equity. It is calculated as:

Return on Equity = Net Income / Shareholders’ Equity × 100

A high ROE indicates that a company is effectively employing its shareholders’ money to generate profits. This ratio serves as an important metric of financial performance, and investors frequently use it to assess how well a firm uses its equity base to create returns. A higher ROE suggests better financial management and a more profitable business model.

How Profitability Ratios Impact Business Decision-Making

Profitability ratios are critical instruments that have a direct impact on key business choices. Companies that analyze these ratios can make more informed pricing, cost control, and resource allocation decisions. For example, a low gross profit margin may cause a company to reevaluate its pricing tactics or look for ways to cut production costs. Similarly, a profit and loss statement can provide further insight into how these costs and revenues contribute to overall profitability.

Similarly, a low operating profit margin may indicate the necessity for an assessment of operational efficiency. Real-world examples demonstrate how companies utilize profitability statistics to make strategic decisions. Businesses may adjust product pricing depending on profitability ratios or cut needless expenses to increase their profit-to-revenue ratio. These decisions help businesses remain competitive and financially healthy.

Who Should Monitor Profitability Ratios?

Key stakeholders, including business owners, financial managers, investors, and analysts, should monitor profitability ratios on a regular basis. For business owners, these ratios provide a clear picture of their company’s financial health, allowing them to make informed decisions. These ratios are used by financial managers and CFOs to fine-tune strategies and maintain the smooth and efficient administration of the company’s finances.

Investors pay great attention to profitability measures when evaluating a company’s financial health and development potential. Regular study of these ratios allows businesses to respond rapidly to changing market conditions, ensuring they remain competitive and profitable in the long term.

Interpreting Profitability Ratios

Understanding profitability ratios is critical to gaining insight into a company’s financial performance. Each ratio offers a unique perspective. For example, a high net profit margin frequently indicates excellent overall profitability, demonstrating that a corporation can effectively transform revenue into profit. On the other hand, a poor return on assets (ROA) may indicate inefficiencies in how a corporation uses its assets to produce profit.

To fully understand these ratios, compare them to industry norms or competitors. This comparison allows firms to better understand their market position and find opportunities for improvement. For businesses in Singapore, adhering to Singapore financial accounting standards is essential for accurate reporting and benchmarking profitability ratios.

Why Are Profitability Ratios Essential for Long-Term Business Growth?

Profitability ratios are critical for identifying shortcomings and pinpointing areas for improvement in a business. Monitoring these ratios enables businesses to identify possible concerns early, allowing them to take corrective action before problems worsen, maintaining financial stability. According to MTI Singapore, 66% of firms were profitable from 2020 to 2022, with a stable median profitability rate of 17%.

For example, a low operating profit margin may indicate operational inefficiencies, but a declining return on equity may show the need for improved capital management. Businesses that constantly track these ratios can plan for long-term growth while avoiding financial trouble.

How to Improve Profitability Ratios

Improving profitability ratios is critical for sustained financial performance and long-term business growth. Businesses can achieve long-term success by focusing on strategic activities that improve efficiency and cost control. Regularly reviewing these indicators is critical to identifying opportunities for improvement. Here are some practical ways to assist in enhancing your profitability ratios:

1. Cost-Cutting Measures

One of the most efficient approaches to enhance profitability ratios is to cut superfluous expenses. This could include renegotiating supplier contracts for better rates, reducing wasteful practices, or optimizing manufacturing processes. Even slight cuts in operational costs can have a substantial impact on the bottom line without losing quality, resulting in higher profit margins. Maintaining accurate records of credit purchases through a purchase journal can also help businesses monitor their spending more effectively.

2. Optimize Pricing Strategy

Another strategy for improving profitability ratios is to review and alter pricing tactics. Businesses can alter their prices to reflect current market value by monitoring market conditions, recognizing client demand, and comparing rival pricing. Offering discounts or premium pricing to specific consumer categories can also assist in enhancing revenue and profit margins.

Additionally, businesses can track earnings per share metrics to evaluate the impact of pricing changes on overall profitability and shareholder value, helping to make more informed pricing and financial decisions.

3. Enhance Operational Efficiency

Improving operational efficiency involves analyzing and refining business processes to reduce waste, increase output, and lower costs. This might include investing in automation tools, optimizing workflows, or even improving inventory accounting systems to better track goods and reduce excess stock. By enhancing efficiency in these areas, businesses can do more with less, boosting profitability and improving key profitability ratios.

4. Regular Reviews and Adjustments

To maintain and enhance profitability ratios, firms should regularly assess performance and make necessary adjustments. By evaluating financial data and recognizing patterns, businesses can adapt to market changes and maintain financial health. According to Smart Nation Singapore, SGFinDex, launched by MAS and SNDGG on 7 Dec 2020, enables Singaporeans to consolidate financial data for more effective planning, offering valuable insights for businesses.

Streamline Your Financial Management with Accounting Software

ScaleOcean’s Revenue Management System simplifies the calculation and examination of profitability ratios, saving time and minimizing errors. By integrating financial data, it delivers reliable, real-time insights into your company’s profitability, making it easier to track performance and make educated decisions. As a leading accounting software vendor in Singapore, ScaleOcean provides businesses with the tools to manage their finances efficiently and optimize their financial operations.

Accounting software guarantees that financial data is accurate and timely, allowing for more informed decision-making. Real-time analytics enable firms to improve cost control, resource allocation, and planning. ScaleOcean provides a free demo to let you learn about its features, and the CTC award will help you improve your financial management even more. The following are significant features of ScaleOcean software.

- Comprehensive Financial Integration, ScaleOcean integrated accounting with all business functions, ensuring seamless data flow and accurate financial reporting.

- Real-Time Financial Insights, It provides real-time financial data, enabling quick adjustments for better decision-making and profitability.

- Automated Profitability Metrics, ScaleOcean automates key profitability ratios, reducing errors and saving time.

- End-to-End Accounting Automation, The software automates all financial transactions from procurement to sales, improving accuracy and reducing manual errors.

- Customizable Financial Reports, ScaleOcean allows businesses to create tailored financial reports for internal and regulatory needs.

Conclusion

Profitability ratios are critical in determining a company’s financial health and making strategic decisions. Businesses that frequently analyze these ratios can find areas of strength and chances for improvement, resulting in improved financial performance and long-term profitability.

Integrating revenue management software can help to make calculating and assessing profitability ratios more efficient. Businesses may use solutions like ScaleOcean to automate these operations, resulting in more accurate and real-time data. This results in better decision-making, increased efficiency, and, eventually, greater business success.

FAQ:

1. What are the five profitability ratios?

The five main profitability ratios are:

1. Gross Profit Margin – Shows the percentage of sales remaining after subtracting the cost of goods sold.

2. Operating Profit Margin – Reflects how effectively a company generates profit from its core business activities.

3. Net Profit Margin – Indicates the portion of revenue that remains after all expenses have been deducted.

4. Return on Assets (ROA) – Evaluates how efficiently a company uses its assets to create profits.

5. Return on Equity (ROE) – Measures how well a company generates profit from shareholders’ equity.

2. What are the 6 profitability ratios?

Along with the five ratios listed above, the sixth important profitability ratio is:

6. EBITDA Margin – Shows earnings before interest, taxes, depreciation, and amortization as a percentage of total revenue.

3. What is the standard profitability ratio?

The “standard” profitability ratio varies depending on the industry and company. However, net profit margin and return on equity (ROE) are commonly used to assess a company’s overall profitability. In general, a higher ratio suggests better performance, but it should be compared to industry norms for accurate assessment.

4. What are the 7 types of ratio analysis?

The seven common types of ratio analysis include:

1. Profitability Ratios – Measure a company’s ability to generate profits from its operations.

2. Liquidity Ratios – Assess a company’s ability to cover short-term financial obligations.

3. Leverage Ratios – Gauge a company’s reliance on debt compared to equity.

4. Efficiency Ratios – Analyze how well a company utilizes its assets to generate revenue.

5. Market Ratios – Measure a company’s market value, such as the price-to-earnings ratio.

6. Activity Ratios – Assess how efficiently a company runs its operations.

7. Return Ratios – Measure the profitability of investments, such as return on equity and return on assets.

PTE LTD..png)

.png)

.png)

.png)

.png)