Understanding the break-even point (BEP) is critical for any firm seeking financial stability and growth. BEP is the sales level at which total revenue matches total costs, indicating that the company is neither profitable nor losing money.

Knowing the break-even threshold is critical for companies functioning in Singapore’s competitive market. It allows them to successfully manage expenses, determine suitable pricing, and make educated decisions that generate profitability.

This article defines the break-even point, explains why break-even analysis is important, and demonstrates how to calculate BEP using key formulas. It also discusses how to analyze BEP results and apply them to strategic business planning.

Businesses that read this article can get useful knowledge to better their finances, control risks, and increase development potential in Singapore’s dynamic business climate. Learn more here!

- The break-even point (BEP) is the sales level at which total revenue equals total costs, meaning a business neither makes a profit nor incurs a loss.

- The importance of BEP analysis is financial planning, performance evaluation, decision-making, improved pricing decisions, enhanced cost control, risk assessment and management, and strategic growth planning

- Calculating BEP using the formula: BEP (Units) = Fixed Costs / (Price per Unit – Variable Cost per Unit) helps businesses determine the minimum sales needed to cover all expenses.

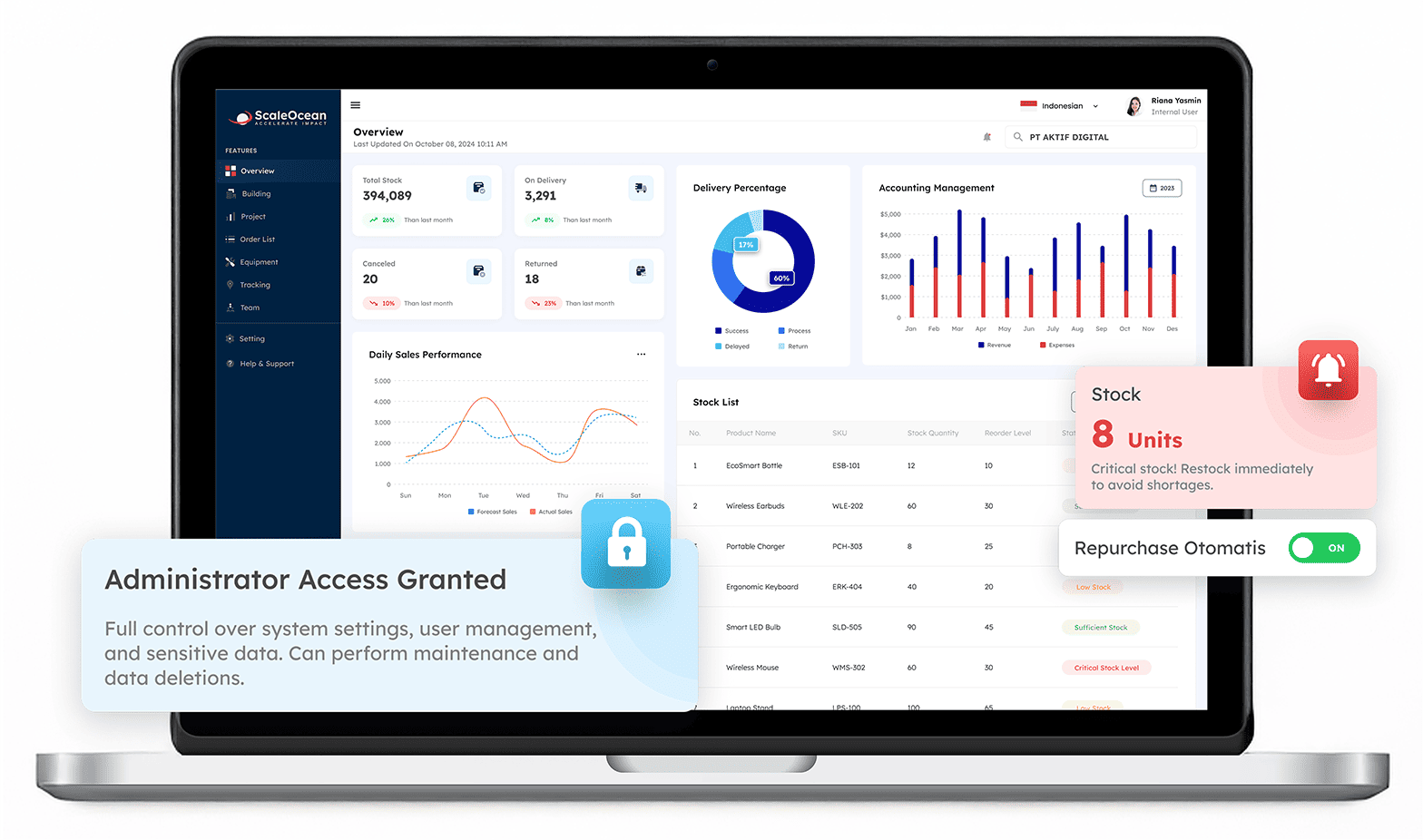

- ScaleOcean software can automate BEP calculations and analysis by integrating key business functions, providing real-time data accuracy, and simplifying financial reporting.

What Is Break-Even Point (BEP)?

The break-even point (BEP) occurs when a company’s total revenue matches its total costs. At this point, the company generates no profit but also incurs no loss. Knowing the BEP helps business owners determine the minimum sales required to cover all expenses.

This information is vital for good financial planning and management. Understanding BEP is particularly crucial for Singapore’s small and medium-sized firms (SMEs). It provides clear indications of when the firm will become successful.

With this information, SMEs may make more informed pricing and cost-control decisions. It also helps to steer business growth and expansion initiatives.

According to InCorp Asia, Singapore’s adoption of the BEPS 2.0 framework with a 15% minimum tax rate offers strategic advantages that encourage better financial planning and compliance among businesses.

Why is Break-Even Point Important?

The break-even point (BEP) is a crucial metric for businesses as it helps determine when a company will start to generate a profit. Understanding the break-even point aids in effective financial planning, shaping pricing strategies, evaluating performance, and supporting decision-making processes.

Especially, BEP also assists Singapore’s small and medium-sized firms (SMEs) in identifying risks associated with price fluctuations, sales volume adjustments, and cost differences. This knowledge enables organizations to respond swiftly to market developments while remaining competitive.

To further enhance this process, companies can leverage a sales pipeline to track and manage their sales opportunities, ensuring that their efforts align with financial goals and help achieve the break-even point efficiently.

How Is Break-Even Point Used?

The break-even point (BEP) is a critical tool used in various aspects of business operations to ensure financial stability and success. By calculating the BEP, businesses can determine the minimum sales needed to avoid losses. Here’s how the break-even point is used across different functions:

1. Pricing Decisions

Businesses use the break-even point to inform their pricing decisions. By understanding the costs required to cover both fixed and variable expenses, companies can set a price that ensures profitability once sales exceed the break-even point. This helps balance competitive pricing with sustainability.

2. Cost Management

The break-even point helps in cost management by identifying the sales volume needed to cover costs. With this knowledge, businesses can focus on reducing unnecessary expenses and improving efficiency, ensuring that the costs do not surpass the threshold where profits are generated.

3. Financial Forecasting

The break-even point is an essential tool for financial forecasting. By analyzing the BEP, companies can predict how changes in sales, pricing, or cost structures will impact profitability. It helps in projecting revenue and profit margins based on different scenarios, assisting in long-term planning.

4. Investment Decisions

When businesses are considering new projects, products, or expansions, the break-even point acts as a guide to assess their financial feasibility. It helps determine how much revenue is required to cover initial investments and ongoing costs, guiding decision-makers in their choices.

5. Risk Management

Using the break-even point helps businesses evaluate risk levels. If a company’s current sales are close to or below the BEP, it indicates potential financial risks, prompting adjustments in strategies to mitigate losses. It provides a clear view of the risk zone and necessary adjustments for profitability.

How to Calculate Break-Even Point

Calculating the break-even point is critical for determining when a business will begin to generate profit. The break-even point can be calculated using the number of units sold or the sales revenue required to cover all costs.

The formula used by a business is determined by the data available. Using these calculations, organizations can calculate the minimum sales required to avert losses and plan appropriately.

1. Calculating the Contribution Margin in Currency

The contribution margin is the amount remaining from sales after variable costs are subtracted, which contributes to covering fixed costs. To calculate the contribution margin in currency:

Formula:

Contribution Margin = Total Sales Revenue – Total Variable Expenses

This figure helps determine how much each unit sold contributes to covering fixed costs. The higher the contribution margin, the fewer units you need to sell to reach the break-even point.

2. Calculating the Unit Contribution Margin

The unit contribution margin represents the contribution margin per unit of product sold. It is calculated by subtracting the variable cost per unit from the selling price per unit. The formula is:

Formula:

Unit Contribution Margin = Sales Price per Unit – Variable Expenses per Unit

This calculation of BEP helps determine how much each unit sold contributes towards covering fixed costs and generating profit.

3. Calculating Break-Even Points Based on Units

To calculate the break-even point in units, you need to know your total fixed costs and contribution margin per unit. This will tell you how many units you need to sell to cover your fixed costs. The formula is:

BEP = Fixed Expenses / Unit CM

or

BEP = Fixed Expenses / (Sales Price per Unit – Variable Expenses per Unit)

This calculation provides the minimum number of units needed to break even. It’s particularly helpful for businesses that sell physical products.

4. Calculating Break-Even Points Based on Sales Dollars

To calculate the break-even point in sales dollars, you can use the contribution margin ratio to figure out the sales needed to cover fixed costs. The formula is:

BEP = Fixed Expenses / (Unit CM / Sales Price)

or

BEP = Fixed Expenses / [(Sales Price per Unit – Variable Expenses per Unit)] / Unit Sales Price)

This gives you the total amount of revenue required to cover all costs. It’s useful for businesses that focus on revenue targets rather than unit sales, such as service-based businesses.

For calculating BEP for the equation and contribution margin are derivatives of each other, you can use this formula:

BEP = Sales Revenue – Variable Expenses – Fixed Expenses = $0

Examples of Calculating Break-Even Point

A company, TechGadgets, sells high-quality wireless headphones. They are trying to determine how many units they need to sell to cover their fixed costs and start making a profit. Here’s the breakdown of their financials:

- Selling Price per Unit: $120

- Variable Cost per Unit: $75

- Fixed Costs (Monthly Rent, Salaries, etc.): $15,000

To know the BEP, firstly, you should calculate the unit contribution margin to represent the amount of money available from each unit sold to cover fixed costs and generate profit. With the right formula and by the financial data of TechGadget, this is the calculation:

Unit Contribution Margin = $120 – $75 = $45. So, TechGadgets earns $45 for every unit sold after covering the variable costs.

After calculating the unit contribution margin, they should calculate how many units TechGadgets needs to sell to cover their fixed costs, and divide the fixed costs by the unit contribution margin. The calculation is: Break-Even Point (Units) = $15,000 ÷ $45 = 333.33 units

Since you can’t sell a fraction of a unit, TechGadgets needs to sell at least 334 units to break even. Which is, they should calculate the BEP in sales dollars to determine the sales revenue required to break even, and multiply the break-even units by the selling price per unit.

The calculation is: Break-Even Point (Sales Dollars) = 334 units × $120 = $40,080

Therefore, TechGadgets needs $40,080 in sales revenue to cover all fixed costs and break even. By this calculation, TechGadgets needs to sell 334 units of wireless headphones to break even.

To reach the break-even point, the company requires $40,080 in total sales revenue. This calculation enables TechGadgets to set clear sales goals and pricing strategies, ensuring they can cover their expenses and achieve profitability.

You can easily manage and analyze your break-even point using Scaleocean sales software. This system integrates various operational data, including sales, fixed costs, and variable costs.

It automatically calculates the break-even point using the financial and sales data available within the platform. You can customize the Scaleocean system to suit your specific business and industry needs. Take a free demo to find the right solution for your business.

What Increases Break-Even Points?

Understanding the factors that increase the break-even point (BEP) is essential for managing costs and ensuring profitability. When the BEP rises, a business needs to sell more products or generate more revenue to cover its fixed and variable costs.

Several factors can drive this increase, and recognizing them helps businesses adapt their strategies effectively, including:

1. Higher Fixed Costs

An increase in fixed costs, such as rent, salaries, insurance, or equipment purchases, will directly raise the break-even point. When these costs go up, the company must generate more revenue to cover the additional expenses before turning a profit. This could mean increasing sales or finding ways to reduce fixed costs.

2. Increase in Variable Costs

If variable costs, like raw materials, labor, or packaging, increase, the contribution margin decreases. As a result, the break-even point rises, meaning the business must sell more units to cover its total costs.

Rising production or supply chain costs can significantly affect profitability, pushing the business to reassess pricing or operational efficiency.

3. Lower Selling Prices

When a company reduces the selling price of its products, the contribution margin decreases. As a result, the break-even point increases because the company must sell more units to achieve the same profit margin.

Businesses may lower prices to stay competitive, but it’s crucial to calculate how this impacts the break-even point and overall profitability.

4. Decline in Sales Volume

A decrease in sales volume can lead to a higher break-even point. Lower sales mean the company must increase the average sales per unit or raise prices to cover fixed costs. This could happen due to market shifts, increased competition, or other external factors that affect customer demand and purchasing behavior.

How to Reduce Break-Even Points

Reducing the break-even point (BEP) is a key strategy for improving profitability and ensuring financial stability. By lowering the BEP, a business can achieve profitability faster and more efficiently.

This can be accomplished through various strategies that target both costs and revenues. Here’s how businesses can reduce their break-even points:

1. Reduce Fixed Costs

One effective way to lower the break-even point is by reducing fixed costs, such as rent, salaries, or utilities.

By negotiating lower rent, automating certain processes, or reducing unnecessary overheads, businesses can decrease their fixed expenses, which directly lowers the amount of sales needed to cover those costs and reach profitability.

2. Lower Variable Costs

Reducing variable costs, such as the cost of materials, labor, or shipping, can significantly decrease the break-even point.

This can be achieved by negotiating with suppliers for better rates, improving operational efficiencies, or outsourcing certain tasks. Lower variable costs allow a business to keep more of each sale, making it easier to cover fixed costs.

3. Increase Prices

Raising the selling price of products or services can increase the contribution margin, which reduces the break-even point.

While this strategy should be used carefully to avoid losing customers, increasing prices can help cover higher costs and generate additional revenue without needing to increase sales volume drastically.

4. Increase Sales Volume

Boosting sales volume, either through marketing efforts or expanding the customer base, can reduce the break-even point. The more units a company sells, the easier it becomes to cover fixed costs.

This strategy focuses on growing market share and increasing demand for products, which helps spread fixed costs over a larger number of units sold.

5. Focus on Higher-Margin Products

Shifting the focus to higher-margin products can help lower the break-even point. By prioritizing products with a higher contribution margin, businesses can cover their fixed costs with fewer units sold. This strategy requires analyzing product lines and promoting those that offer the best profit potential.

How Break-Even Analysis Works

Break-even analysis is a powerful tool that helps businesses determine the level of sales needed to cover all costs, with no profit or loss. It enables companies to understand their cost structure, set sales targets, and make informed decisions about pricing and cost management.

Here’s how break-even analysis works and its key components.

1. Identifying Fixed and Variable Costs

The first step in break-even analysis is identifying fixed and variable costs. Fixed costs remain constant regardless of production or sales volume, such as rent or salaries. Variable costs change with the level of production, such as raw materials and labor.

Understanding these costs is crucial for calculating the break-even point and planning for profitability.

2. Calculating Contribution Margin

The contribution margin represents the difference between the selling price of a product and its variable costs. It shows how much money is available from each sale to cover fixed costs.

The contribution margin is calculated by subtracting variable costs per unit from the selling price per unit, providing insight into how much profit is generated per unit sold.

3. Break-Even Point Calculation

The break-even point is calculated by dividing total fixed costs by the unit contribution margin. This tells you the number of units that need to be sold to cover fixed costs. Once this point is reached, the business will start generating a profit.

You can calculate it based on the formula explained previously, complete with calculation examples to make it easier to understand.

4. Break-Even Analysis for Decision-Making

Break-even analysis helps businesses make important decisions, such as pricing strategies, cost management, and profitability forecasting.

By calculating the break-even point, businesses can determine if their current pricing structure and sales targets will cover costs or if adjustments are needed to improve financial outcomes.

5. Scenario Planning and Sensitivity Analysis

Break-even analysis allows businesses to run “what-if” scenarios and sensitivity analysis. By altering variables such as sales volume, costs, or pricing, companies can assess how changes in these factors affect the break-even point.

This helps businesses plan for potential risks and opportunities and adapt their strategies accordingly.

Benefits of Break-Even Point Analysis

Analyzing the break-even point (BEP) has numerous benefits that enable firms to make better financial decisions. Calculating BEP is crucial because it reveals the minimum sales volume needed to cover all costs, helping businesses avoid losses and maintain financial stability.

Understanding the BEP analysis enables businesses to develop pricing strategies, manage expenses more effectively, and plan for long-term growth. Without this insight, companies risk setting prices too low or overestimating sales, which can lead to cash flow problems and threaten business survival.

The following are the primary benefits of doing a thorough break-even analysis, including:

1. Financial Planning

The break-even point plays a pivotal role in financial planning by providing clarity on the minimum sales needed to cover costs. This allows businesses to set realistic revenue targets, ensuring they can make informed projections for cash flow, profitability, and resource allocation to sustain operations.

2. Performance Evaluation

The break-even point serves as a benchmark for performance evaluation. It helps businesses assess how effectively they are managing costs and driving revenue.

If sales are consistently above the break-even point, it indicates strong operational efficiency and market demand, while falling below signals the need for strategic adjustments.

3. Decision-Making

The break-even point is vital for decision-making, particularly when considering new investments or expansions.

It offers insight into whether a business venture is financially viable by showing how much additional revenue is needed to cover new costs, helping executives make informed, data-driven decisions for sustainable growth.

4. Improved Pricing Decisions

Understanding the break-even point enables firms to set pricing that covers costs while remaining competitive. It defines the minimal price required to avoid losses, allowing businesses to balance profitability and market demand.

This ensures that pricing plans are sustainable and in line with business objectives. Additionally, this ties directly to the advantages of the profitability ratio, as both metrics help to optimize financial decision-making.

5. Enhanced Cost Control

Break-even analysis reveals how fixed and variable costs relate, helping firms identify cost-saving opportunities. This improves spending efficiency and financial health. Effective management boosts profit margins and business resilience.

According to the Infocomm Media Development Authority (IMDA), Singapore’s Business Intelligence (BI) tools enable businesses to analyze product sales, cost, and inventory turnover patterns.

6. Risk Assessment and Management

Companies can calculate the margin of safety using BEP to determine how much sales can decrease before losses arise. This aids in identifying financial risks and developing contingency strategies. Being aware of these dangers enables more proactive decision-making amid market changes.

7. Strategic Growth Planning

BEP analysis gives specific sales targets essential for profitability. Businesses can utilize this data to create realistic growth targets, allocate resources more efficiently, and track success over time. This strategy promotes sustainable growth and improved resource management.

8. Better Budgeting and Forecasting

Understanding break-even sales volume helps to create more realistic budgets and financial predictions. It guarantees that estimates are based on realistic cost and revenue assumptions, resulting in better financial planning. Reliable projections allow organizations to make educated investment and operational decisions.

How to Interpret Break-Even Analysis Results in Businesses

Once you’ve calculated your break-even point (BEP), it’s important to analyze what the numbers mean for your business’s financial health and risks. Understanding the implications of your BEP helps you identify how vulnerable your company is to changes in sales and costs, allowing you to take proactive steps to protect profitability.

By interpreting these figures accurately, you can make better-informed decisions regarding pricing, cost management, and strategic planning. These concepts are critical for making sound judgments and managing your business efficiently.

1. Calculate and Monitor Margin of Safety

The margin of safety is found by subtracting your break-even sales from your actual sales. This figure indicates how much sales can decline before your business starts operating at a loss.

A larger margin of safety means your business is better protected against unexpected drops in sales, providing a cushion during market downturns or seasonal fluctuations.

Regularly monitoring this margin helps you assess the stability of your profits and enables proactive measures to safeguard your financial position when sales trends show signs of weakening.

2. Assess Operating Leverage

Operating leverage refers to the proportion of fixed costs compared to total costs in your business. When operating leverage is high, it means your business has a larger amount of fixed costs relative to variable costs, so small changes in sales volume can lead to significant fluctuations in profits.

Understanding your operating leverage allows you to better manage your cost structure and prepare for changes in market demand.

For example, businesses with high operating leverage should focus on increasing sales volume to spread fixed costs more efficiently, while also being cautious about the risks of sales declines that could disproportionately impact profitability.

Using Break-Even Insights for Strategic Business Decisions

Using break-even point (BEP) data is critical for making strategic business decisions. It enables firms to set effective pricing by displaying the minimal sales required to cover expenditures.

BEP data also influences cost-cutting efforts, enabling businesses to discover and eliminate needless spending. Furthermore, knowing BEP aids growth planning by identifying the sales targets required to meet profitability and expansion objectives.

Continuous monitoring of the break-even point is critical for responding to market developments, particularly in dynamic environments such as Singapore. Regularly evaluating BEP enables organizations to adapt swiftly to changes in costs, competition, or client demand.

This proactive strategy guarantees that businesses remain financially healthy and make educated decisions that are consistent with changing market conditions.

Manage and Analyze Break-Even Point Accurately with Scaleocean

ScaleOcean Sales Software is designed to help businesses automate complex financial tasks like break-even point (BEP) calculations. This system can integrate various business functions such as sales, purchasing, inventory, and production.

It ensures real-time data accuracy and seamless synchronization. This integration provides businesses with faster insights, reduces errors, streamlines financial reporting, and makes it easier to monitor costs, revenues, and profitability all in one platform.

For businesses looking to improve their financial management, ScaleOcean offers a free demo to explore its powerful features. Additionally, companies in Singapore may benefit from the CTC (Capability Transfer Programme) grant, which supports adopting digital solutions like ScaleOcean. Below is a list of key features of ScaleOcean software:

- Centralized Sales Management: Sales data (quotations to invoices) can be managed in one system for easy performance monitoring and analysis.

- Sales Performance Tracking and Projections: Sales pipeline and sales forecasting features can help you project revenue based on planned sales to calculate BEP.

- Integration with Finance and Inventory Modules: Automatically calculates fixed and variable costs as key components in BEP calculations.

- Real-Time Reporting and Analysis: Provides BEP reports that can be customized to business needs, making it easier to monitor changes in costs and revenue that affect BEP and identify strategic steps to achieve it more quickly.

Overall, these ScaleOcean’s sales Software features provide a clearer picture of when the company will reach breakeven and enable strategy adjustments to improve efficiency and profitability.

Conclusion

The break-even point (BEP) is a significant financial management tool that helps firms determine when they will begin to profit. It offers clear insights into cost structures, pricing strategies, and sales targets, allowing for better budgeting and risk assessment.

Mastering BEP analysis is critical for Singaporean organizations seeking financial stability and long-term growth in a competitive market. Discover how ScaleOcean’s sales system help streamline and optimize your financial plans by automating BEP calculations and giving real-time data insights.

Use our tools to improve decision-making, control costs, and accelerate corporate growth. Begin today with a free demo to see the benefits yourself. Request a free demo to get this solution for your business.

FAQ:

1. What is the purpose of BEP?

The purpose of the break-even point (BEP) is to help businesses calculate the number of units or sales dollars needed to cover both fixed and variable costs. Once the BEP is reached, any additional sales will generate profit, as they surpass the company’s expenses.

2. What is a good break-even ratio?

A good break-even ratio is typically considered to be 85% or lower, as this provides lenders with a sufficient financial buffer. This cushion helps protect the borrower in case expenses rise or the property experiences an unexpected drop in occupancy.

3. Does break-even mean no profit?

The break-even point is when your total revenue (sales or turnover) matches your total costs. At this stage, there is neither profit nor loss, meaning you simply “break even.”

4. Is a high or low break-even point better?

A higher break-even point means your business needs to make more sales to cover costs, making it harder to achieve profitability. Conversely, a lower break-even point requires fewer sales to cover costs, potentially making it easier for the business to become profitable.

PTE LTD..png)

.png)

.png)

.png)

.png)