Churn rate is the percentage of customers who discontinue using a company’s product or service, and it is critical for analyzing retention and satisfaction, particularly in competitive markets such as Singapore. According to NLB Singapore, boosting client retention by just 5% can increase profitability by 25 to 95 percent, whereas gaining new customers can cost five to 25 times as much as retaining existing ones. Loyal customers are more likely to purchase from trusted businesses, therefore understanding churn rate is critical for identifying and addressing retention concerns.

Understanding the churn rate allows firms to take proactive efforts to reduce attrition and increase client loyalty. The purpose of this article is to explain the importance of churn rate, the factors that drive it, and successful management solutions. We will also look at how firms in Singapore may use this data to generate growth and strengthen customer connections.

- Churn rate is a key performance indicator (KPI) that measures the percentage of customers who stop using a product or service within a specific time period.

- In business, churn refers to the rate at which customers, subscribers, or clients discontinue using a company’s product or service.

- Reducing churn is essential for business success, as retaining existing customers is often more cost-effective than acquiring new ones.

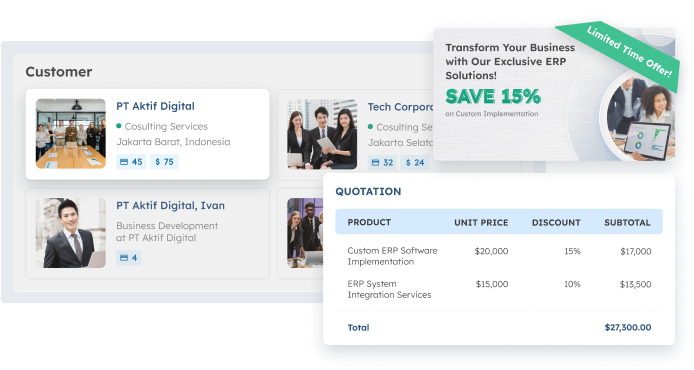

- ScaleOcean’s unified Sales & CRM platform accelerates revenue growth by automating sales processes and optimizing customer relationships.

1. What Is the Churn Rate?

Churn rate is a key performance indicator (KPI) that calculates the percentage of consumers who stop using a product or service after a specified time period, such as a month or a year. This indicator allows organizations to assess how well they retain consumers and whether their products or services exceed customer expectations.

A larger turnover rate may suggest issues such as customer unhappiness, a lack of value, or intense rivalry, whereas a low churn rate frequently indicates strong customer loyalty and satisfaction. By identifying turnover rate, businesses may take proactive efforts to strengthen retention strategies and reduce customer attrition, resulting in long-term business success.

2. What Does Churn Mean in Business?

In business, churn is the rate at which consumers, subscribers, or clients discontinue utilizing a company’s product or service. This might be due to a variety of circumstances, including unhappiness with the product, more competitive offerings, or changing client needs.

By tracking churn, organizations can discover the causes that are causing client loss and take actions to strengthen retention methods. Monitoring churn is critical for determining the success of client interaction and identifying where changes or upgrades are required to maintain a loyal customer base.

3. Churn Rate vs. Growth Rate

Churn rate and growth rate are two significant measures that provide complementing information about a company’s effectiveness. The churn rate is the percentage of customers who quit a firm during a given time period. It focuses on customer retention difficulties. On the other hand, the growth rate measures how rapidly a company acquires new clients. It demonstrates the company’s capacity to recruit and expand its consumer base.

When both measurements are considered combined, they paint a clear picture of a company’s stability. A high churn rate combined with a low growth rate indicates that a company is losing consumers while simultaneously failing to replace them successfully. This combination may indicate underlying concerns, such as customer dissatisfaction, inefficient marketing, or a lack of competitive advantages, which must be addressed in order to achieve long-term success.

4. Benefits of Churn Rate

Understanding turnover rate provides major benefits to firms seeking to improve client retention and overall performance. Businesses that routinely analyze this measure might acquire useful insights into their operations and consumer interactions. In fact, the International Trade Administration estimates that Singapore’s ICT sector would increase by 8.6% in 2022, exceeding the entire economy’s 3.6% growth.

This development highlights the growing relevance of digitization in strengthening customer loyalty and operational efficiency, making turnover rate control even more critical for organizations in today’s competitive environment. Here are five main benefits:

a. Identify Customer Retention Issues

Tracking churn enables organizations to identify precise reasons why customers leave, such as unhappiness with the product or service. By analyzing churn as a KPI, Understanding these causes allows firms to take focused efforts to remedy concerns, ultimately increasing retention rates.

b. Improve Customer Experience

Analyzing turnover data allows firms to identify patterns of customer unhappiness, which can indicate areas for improvement. By leveraging tools like CRM software, businesses can track customer interactions and feedback more effectively, pinpointing issues that lead to dissatisfaction. Addressing these trends allows businesses to improve their products, services, and overall experience, resulting in increased consumer satisfaction and loyalty.

c. Assess Marketing Strategies

A growing churn rate may suggest that marketing campaigns or customer acquisition techniques are not reaching the intended audience. By analyzing turnover data, firms can find gaps in their approach and tailor their marketing strategies to attract and keep more clients.

d. Predict Future Revenue

Churn trends provide vital information about future revenue potential. If a company’s churn rate is high, it can expect diminishing revenue until remedial steps are implemented. Monitoring churn allows firms to make more informed decisions about future development and sustainability.

e. Optimize Customer Support

A high turnover rate may indicate that customer service is not fulfilling expectations. By evaluating churn data, organizations may determine whether their customer support team is efficiently addressing issues and making required improvements to provide better service and reduce client loss.

5. Downsides of Churn Rate

While churn rate is a useful indicator for determining client retention, it has several disadvantages. The turnover rate alone may not provide an accurate picture of a company’s health or the true causes of customer attrition. Here are the five disadvantages:

a. Doesn’t Account for Reasons

Churn rate estimates how many customers depart, but it does not reveal why they are leaving. Without an understanding of the reasons for customer departures—whether due to product dissatisfaction, competitor offerings, or other factors—it is impossible for organizations to address the underlying issues. Due to the lack of context, organizations must perform further surveys or research to properly understand the causes of churn.

b. May Be Misleading in Isolation

Churn rate, on its own, does not provide a whole picture of a company’s performance. Churn rate can be misleading when examined in isolation from other crucial variables such as growth rate or client acquisition expenses. A high churn rate, for example, may appear concerning, but if the company continues to grow its client base at a rapid pace, the whole business may be on a favorable trajectory. As a result, organizations should always consider turnover in the context of other performance indicators.

c. Doesn’t Capture Customer Quality

The churn rate merely measures the number of customers lost, not their quality or value to the business. Losing a few high-value clients can have a far higher impact on revenue than losing a large number of low-value customers. As a result, churn rate alone may miss the nuances of client value, hence it is critical to analyze other indicators such as customer lifetime value (CLV) to gain a more complete understanding of the impact.

d. Requires Constant Monitoring

To be genuinely effective, the churn rate must be tracked over time. A single snapshot of churn data may not provide sufficient insight, and failing to monitor this statistic on a frequent basis may result in missed churn prevention efforts. Without constant tracking, firms risk overlooking emerging patterns or changes in customer behavior that may be handled before they result in a larger loss.

e. Can Be Influenced by External Factors

Economic downturns, business upheavals, and seasonal fluctuations can all have an impact on a company’s churn rate. For example, during a downturn, consumers may depart owing to budget cuts or shifting priorities, even if the business is doing well. These external influences can skew turnover data, making it difficult for organizations to distinguish between problems that can be solved internally and those caused by broader market pressures.

6. Understanding Churn Rate Through an Example

Consider a subscription-based firm that begins with 1,000 consumers at the start of each month. By the end of the month, 100 clients had unsubscribed. To get the churn rate, divide the number of lost customers (100) by the total number of customers at the beginning of the month (1,000). Then, multiply by 100 to get the percentage.

In this scenario, the churn rate would be (100/1,000) × 100, or 10%. This means that the company lost 10% of its customer base during that time, revealing a clear picture of consumer loyalty. A larger turnover rate may suggest problems with client satisfaction, whereas a lower percentage typically indicates strong loyalty and effective retention methods.

7. Employee Turnover Rate

The employment churn rate is the percentage of employees who leave an organization over a certain time period, which is commonly determined by dividing the number of departures by the total number of employees at the beginning of the period. A high churn rate frequently indicates underlying issues such as job discontent, inadequate salary, a lack of career advancement, or a hostile workplace culture. It’s an important statistic for assessing staff turnover and its possible influence on the firm.

Monitoring the job churn rate enables businesses to evaluate their personnel retention tactics. High turnover increases recruitment and training expenses, lowers team morale, and causes the loss of valuable experience. By tracking this rate on a regular basis, organizations can discover patterns, address concerns early, and take targeted actions—such as enhancing culture, offering better compensation, or developing clearer career advancement paths—to reduce churn and enhance overall retention.

8. Churn Rate Calculation Method

To properly track client retention, organizations must understand and compute the churn rate. This indicator is critical for determining how many clients a firm has lost over a certain time period, allowing businesses to detect potential flaws with their service or product offerings. A high churn rate could indicate discontent or unfulfilled needs, whereas a low churn rate indicates strong client loyalty. The formula for calculating the churn rate is as follows:

Churn Rate = (Customers Lost / Customers at the Start of the Period) × 100

To calculate the churn rate, first figure out how many clients there were at the start of the period under consideration. This is your initial customer base. Then, calculate the amount of clients lost during the same time period, which could include cancellations, unsubscribes, or any other sort of attrition. Next, divide the number of lost consumers by the total number of customers at the start of the term. Finally, multiply the value by 100 to calculate the percentage.

For example, if your business starts with 500 consumers and loses 50 by the end of the month, reduce 50 by 500 to get 0.1. When multiplied by 100, the turnover rate equals 10%. This means you lost 10% of your consumers over that time period. Calculating the turnover rate this way provides a comprehensive picture of customer attrition, allowing firms to track their customer retention success over time.

9. What’s Considered a Good Churn Rate?

A “good” turnover rate varies according to industry and business type. For subscription-based businesses, a churn rate of 5-7% per year is generally considered healthy. SaaS organizations frequently strive for rates below 5% because they rely on recurring revenue, but retail enterprises may see higher churn owing to less frequent transactions.

Companies with excellent customer involvement, such as those with loyalty programs, have reduced churn rates, often less than 5%. A “good” turnover rate represents a company’s ability to keep customers, whereas larger rates may indicate problems with customer happiness or product-market fit.

10. What’s a High Churn Rate?

A high churn rate shows that a company is losing customers quicker than it is acquiring new ones. This frequently indicates deeper concerns such as poor product performance, a lack of client happiness, insufficient customer assistance, or superior offerings by competitors.

High churn may also indicate inefficient marketing efforts or a mismatch between client expectations and what the company offers. To solve this, businesses must identify the causes of churn, whether through customer feedback, surveys, or data analysis, and implement focused retention measures, such as improving product quality, customer service, or loyalty programs.

11. Effective Ways to Reduce Customer Churn

Reducing churn is critical for corporate success since retaining existing customers is typically cheaper than recruiting new ones. A high churn rate can have a substantial impact on a company’s bottom line, therefore it’s critical to take proactive measures to reduce client turnover. Here are some ways to help you reduce client attrition.

a. Understanding Churn Rate Factors

It’s critical to discover the core causes of client departure. This could range from unhappiness with the goods or service to inadequate customer service or unmet expectations. Exit surveys, feedback analysis, and tracking consumer behavior trends can all assist firms identify these difficulties and adopt corrective actions to solve underlying problems.

b. Resources and Education to Improve Churn Rate

Offering clients clear and accessible materials, like as tutorials, FAQs, and onboarding instructions, can help them fully utilize your product or service. This technique not only improves customer pleasure but also minimizes frustration, which increases the likelihood of retention. Regularly updated educational content keeps consumers interested and informed about new features, updates, and best practices.

c. Ensure Correct Audience Targeting for Better Churn Rate

Customer retention depends on ensuring that your marketing and sales activities are targeted at the proper audience. Focus on clients who are most likely to benefit from your product or service. By adapting your offerings and communication to your ideal clients’ precise wants and pain spots, you may dramatically lessen the likelihood that they will leave due to a bad match.

d. Identifying Signs of Potential Churn Rate

Being proactive in identifying early warning indicators can help you avoid client turnover before it starts. Keep an eye out for signs of decreased usage, lower engagement, or a spike in complaints or bad feedback. Identifying these signs early allows firms to take prompt action, such as reaching out to give assistance, specialized solutions, or incentives to re-engage the customer.

12. Grow Revenue Faster with Software Sales & CRM Centralized by ScaleOcean

ScaleOcean’s unified Sales & CRM platform helps businesses increase revenue faster by automating sales operations and optimizing client connections. This all-in-one solution streamlines complicated workflows by leveraging sophisticated automation, seamless integrations, and real-time data to drive efficiency and scalability. ScaleOcean is designed to meet the specific demands of organizations, allowing them to manage infinite users without incurring additional costs, making it appropriate for both small businesses and large corporations looking for rapid expansion.

Take advantage of ScaleOcean’s free demo to see how its comprehensive features can help with your sales and CRM operations. Additionally, firms in Singapore can benefit from the CTC grant, which helps defray the expenses of implementing innovative technology solutions such as ScaleOcean. ScaleOcean’s software has the following unique selling characteristics (USPs):

- Built on Best Practices for Effective Churn Rate Management, ScaleOcean is intended to handle critical business concerns, such as attrition rate management, by simplifying operational procedures and boosting customer relationship management (CRM).

- Comprehensive All-in-One CRM Solution to Reduce Churn Rate, ScaleOcean provides a comprehensive CRM solution with over 200 customisable modules and 1000+ capabilities, allowing organizations to better track and manage client relationships.

- Flat and Rational Pricing Model for Scalable CRM and Churn Rate Optimization, ScaleOcean’s flat price strategy allows firms to scale their CRM operations without worrying about hidden expenses, while also offering a cost-effective solution to churn management.

- Business Operations on Auto-pilot to Improve CRM and Reduce Churn, ScaleOcean’s automation features handle regular activities, allowing organizations to focus on developing great client relationships and lowering churn.

13. Conclusion

Understanding and managing the turnover rate is critical for corporate growth. Businesses may improve customer retention, boost their CRM strategy, and, ultimately, generate revenue development by analyzing and addressing the causes of client turnover. Metrics such as churn rate and growth rate provide useful insights into a company’s health, and applying churn-reduction techniques can have a substantial beneficial impact on long-term success.

ScaleOcean is a comprehensive, all-in-one software solution to help businesses manage their CRM and reduce churn. It streamlines processes and improves customer connections. ScaleOcean simplifies business scaling by incorporating best practices, automation, and a flat pricing strategy. Take advantage of ScaleOcean’s free demo to learn how its capabilities can help you reduce churn, increase client loyalty, and drive business growth.

PTE LTD..png)

.png)

.png)

.png)

.png)