Revenue streams are the heartbeat of any business, showing exactly how money flows in to keep things running. Whether you’re selling products or services, truly understanding these income sources is the secret to long-term growth and staying power.

According to Marketing Interactive, in Singapore, 84% of firms use digital marketing, yet only 17% see it directly boosting revenue. This gap shows why it’s so important to sync your marketing with a smart revenue management plan to actually unlock your business’s full potential.

To help fix this, in this article, we’ll dive into what is the meaning of revenue streams, such as what revenue streams are, how these income sources work, and how to manage them. By the end of this guide, you’ll have the tools to diversify your money-making channels and optimize your growth for the long run.

- Revenue streams are basically the different ways a business brings in money, whether that’s through services, products, subscriptions, or something else.

- The importance of revenue streams is that they help reduce risk, improve stability, and make your business more attractive to investors.

- Knowing how to analyze revenue streams helps identify profitable areas and uncover where improvement is needed.

- ScaleOcean’s revenue software helps you manage all streams in one platform, giving you clarity and control at every step.

What Are Revenue Streams?

Revenue streams are basically the different ways a business brings in money, whether that’s through services, products, subscriptions, or something else. Knowing the revenue stream’s meaning gives a clearer picture of how a company actually keeps itself running day to day.

At the core of it, it’s just about the sources of income, where the money actually comes from. Some companies stick with one main method, while others spread across several depending on what fits their setup.

If you’ve ever wondered what is revenue stream is in real business terms, it’s not as technical as it sounds. It’s just the answer to how a company gets paid.

What Is the Importance of Revenue Streams?

Revenue streams are vital for your financial health. Per the Ministry of Finance, similar to the NIRC’s $27.14 billion for 2025, robust, varied income ensures you can weather shifts and expand. Having diverse sources keeps you stable and ready for whatever the future brings.

So, revenue streams do more than just keep the lights on it’s also because they’re also the lifeblood of a sustainable business. By mixing up your sources of income, you can smooth out operations, lower your risks, and plan for future growth with confidence. Here’s why having multiple streams is so vital:

- Stability: Relying on just one income source can feel risky, even when that one slows down, cause everything feels off-balance. Having multiple revenue streams helps cushion the blow if something shifts unexpectedly.

- Growth Planning: When you know where your income is coming from, it’s easier to make long-term decisions that actually make sense. Clear revenue direction gives teams more confidence when planning what’s next.

- Risk Management: Markets change, sometimes fast, and it’s hard to predict which way things will go. Diversifying income sources tends to reduce how vulnerable your business feels when that happens.

- Investor Appeal: It’s not just about how much you earn, but where it comes from. Multiple revenue streams often signal stronger business health, and that can catch the attention of investors more easily.

- Cash Flow Insight: Tracking which areas of your business actually bring in consistent income helps keep things running smoothly. Knowing what’s steady and what’s seasonal makes it easier to plan with less guesswork.

How Do Revenue Streams Work?

At the core, revenue streams are just the different ways a business earns money from what it does. Whether it’s selling physical products, offering subscriptions, or charging for licenses, it all comes down to how value gets turned into income.

Each type of revenue stream tends to move differently. Some are predictable and steady, others might spike seasonally or depend on one-off purchases, and knowing that rhythm helps improve profitability and efficiency in how they’re managed.

For example, a retail brand might depend on large volumes of lower-cost sales, while a SaaS company usually bets on monthly or yearly renewals. The goal here is to figure out what makes the most sense for your model, so it’s not just what looks good on paper.

Types of Revenue Streams

Revenue streams are the true lifeblood of your business, bringing in income from various sources. By understanding the different types, you can build a balanced plan for growth and stability. Let’s dive into the most common revenue streams to help you achieve long-term success:

- Transaction-Based Revenue: This one’s pretty straightforward because you make money each time a sale or deal goes through. It’s a common setup for retail or e-commerce, but it can also apply to a lot of one-off purchase models.

- Project Revenue: Usually tied to client-specific work, like a website build or design project, and it’s done when it’s done. Not the most predictable flow, but it can bring in bigger chunks at once when managed well.

- Service-Consulting Revenue: Here, you’re often billing based on time, skill, or some form of expertise being shared. This model suits freelancers or consultants who work directly with clients in more flexible formats.

- Recurring Revenue: Think subscriptions, memberships, or retainer-based services, anything that brings in money regularly. This tends to provide more stability, especially when trying to forecast or plan long-term.

- Balancing Revenue Streams: Relying on just one income type can be risky, so mixing a few makes sense for many. Blending models helps smooth out the ups and downs, especially in uncertain markets or seasonal industries.

Examples of Revenue Streams

Income streams come in many forms, each bringing its own set of perks and hurdles. By mixing up how you earn, you build a stronger financial base that can handle market shifts and reach long-term goals. Here are a few common ways businesses keep the revenue flowing:

- Product Sales Revenue: This one’s pretty straightforward. It’s the money you make from selling physical or digital products directly. It’s often the core stream for most companies, especially early on when building out consistent revenue.

- Licensing Revenue: If you’ve got intellectual property, like software, branding, or content, you can let others use it for a fee. This model works well when scaling without needing to produce or ship anything new.

- Ancillary Revenue: These are the little extras, things like extended warranties, setup fees, or premium support. While they’re not the main dish, they can really add up over time if done right.

- Metered-Service Revenue: This is the “pay-as-you-go” setup, where customers are charged based on usage, such as cloud storage or data plans. It’s flexible and tends to work well when users’ needs vary over time.

- Advertising Revenue: If you’ve built a platform with decent traffic, say a blog, app, or video channel, then showing ads can bring in some extra income. It’s not always predictable, but it does scale with audience size.

- Leasing and Renting: Instead of selling the asset, you let someone use it temporarily and charge for the time. This stream works best with things like equipment, vehicles, or space.

- Brokerage Fees Revenue: In this case, you’re not selling anything yourself cause you’re connecting buyers and sellers and taking a cut. It’s a common model for marketplaces and service platforms.

- Interest Revenue: This one comes from earning interest on money that’s been loaned out or invested. It’s passive, yes, but it requires capital upfront and often a longer timeline to see results.

How to Analyze the Revenue Stream of a Business

It helps to break things down one by one, look at each revenue stream on its own, and figure out what’s driving it, who’s actually paying, and how frequently that money’s coming in. That way, you get a clearer sense of how each stream is performing, instead of lumping everything together.

From there, take a closer look at the profitability of each stream. You might notice some are quietly stalling while others are steadily growing. This kind of contrast can really help decide where it makes the most sense to double down or pull back.

Don’t skip the numbers that tell the real story for tracking things like churn, average revenue per customer, and gross margin. These core metrics paint a fuller picture than top-line revenue alone ever could.

9 Strategies for Developing New Revenue Streams

Developing new revenue streams is key to ensuring business growth and long-term success. By diversifying income sources, companies can increase their financial stability and mitigate risks. Here are nine strategies to help unlock additional revenue opportunities:

1. Implement Recurring Revenue Streams

Recurring setups like subscriptions or retainer agreements can really help bring a bit of structure. You get a clearer picture of what’s coming in each month, which makes revenue planning easier to manage overall.

What’s also nice is that this kind of model tends to build longer-term relationships. Over time, that can lead to a higher customer lifetime value, which is usually better for both sides.

2. Explore New Markets and Channels

If sales feel like they’ve hit a wall in your usual market, it might be worth exploring other regions or even different types of customers. Sometimes just shifting your focus slightly can open up fresh revenue opportunities you hadn’t considered.

Another route is branching out into new sales channels, such as things like online marketplaces or even affiliate partnerships. Diversifying access points like these tends to make sense when you’re trying to reach audiences that aren’t already in your usual orbit.

3. Expand Product/Service Lines

Offering a slightly upgraded version of your service, or even just a small add-on product, can actually go a long way in raising your average order size. It’s one of those moves that pulls more value from your existing customers without pushing too hard.

You don’t always need to build something brand new from scratch. A lot of the time, it’s more about recognizing what’s already working and just adding layers that naturally fit, not flipping the whole model.

4. Monetize Your Expertise

If you’ve spent time learning the ins and outs of your field, there’s probably a way to turn that knowledge into a revenue stream. Things like hosting a small workshop, offering an online course, or even speaking at events can actually generate consistent income if done right.

This tends to work well if you’re in a niche or consulting space, somewhere your perspective isn’t easily replaced. There are folks out there actively looking for specialized insights that can save them time, fix a tough issue, or just help them level up.

5. Leverage Existing Customer Relationship

It’s usually a lot easier to sell something new to someone who’s already bought from you before. If there’s trust built up, your existing customers can be your most reliable revenue stream without needing to chase down cold leads.

What tends to work well here is using their previous activity to shape what you offer next. Personalization doesn’t just improve the chances they’ll say yes. It also helps maintain a stronger connection over time.

6. Form a Strategic Partnership

Teaming up with other businesses can be a smart way to reach new people without having to build everything from the ground up. It’s not uncommon to see co-branded offerings open up new revenue channels pretty quickly when both sides bring something valuable.

But it only really works if there’s actual alignment, not just on paper, but in how each company operates and what they care about. When there’s a strategic fit, things tend to move smoothly and with less friction, which helps avoid unnecessary back-and-forth later.

7. License and White-Label Products

When a product really works, it’s not unusual for others to want to sell it under their own name. With licensing, you can let them do just that without having to handle all the marketing or distribution yourself.

White-label deals kind of follow the same idea. Someone else puts in the effort to promote it, and you earn a cut, which makes this scale income model a practical route for passive revenue.

8. Digital and Technological Integration

It pays to use tools that handle the heavy lifting, from CRMs to basic automation. When hunting for the best revenue management system in Singapore, it’s not just about saving time also it’s about using tech to scale your business without making things feel more complicated.

Once the right systems are in place, you start noticing fewer slip-ups and a much clearer view of how things are actually performing. Data-backed decisions aren’t just a trend. They give you something real to work with when figuring out what’s working and what needs a rethink.

9. Upselling Strategies

Sometimes it’s not about finding more customers, but helping the ones you already have get a little more of what they actually need. Encouraging an upgrade or add-on can boost your revenue stream without going out to chase cold leads. To make this successful, the offer must align with the customer’s needs and provide real value.

That’s where ScaleOcean ERP software comes in, supporting all of the strategies above, like upselling by providing comprehensive insights, streamlining customer management, and offering more ability to offer relevant solutions that drive additional revenue.

Choosing the Right Revenue Streams: Key Considerations

Picking the right revenue streams is key to keeping your business growing and healthy. By checking a few vital factors, you can focus on the most profitable areas that truly match your long-term goals.

Here are some essential things to consider when choosing your next big opportunity:

- Ideal Customer Profile: It’s not just about selling something. It’s about knowing who you’re selling to. The clearer you are about your ideal buyer, the easier it becomes to create something they’ll actually pay for.

- Existing Customer Base: Take a look at what your current customers are already purchasing because there’s usually a pattern. Understanding what they value can help shape where to grow next.

- Value Proposition: Ask yourself, what do you offer that they can’t easily get somewhere else? Your unique benefit is often the main reason someone chooses you over a competitor.

- Competition: You don’t need to obsess over them, but it helps to know who else is out there. Where you sit in the market gives context to your pricing and positioning.

- Sales and Marketing Channels: It’s one thing to have a great product, but can you actually reach people who want it? Finding the right channels can make or break the effectiveness of your revenue stream.

- Existing Products and Services: Sometimes you don’t need something brand new, just a smart extension. Ask if what you already have can be adapted or bundled differently to bring in more value.

- Profit margin on product and service: Before scaling, you must ensure the effort is actually worth it. A healthy profit margin is a great sign that your business model is sustainable. It shows that investing more time and resources will likely lead to bigger returns and long-term success for your company.

Manage Revenue Streams Comprehensively with ScaleOcean

The software is built to fit your industry perfectly, letting you fine-tune your unique workflows. With AI automation, it spots trends and forecasts revenue, giving you the best strategies to grow while keeping your financial management smooth and easy.

ScaleOcean offers businesses a seamless way to access CTC grants, allowing you to leverage advanced tools without the financial burden. By using AI-driven features, ScaleOcean helps you sharpen your revenue strategy and smooth out financial tasks to boost growth, all while staying fully eligible for the CTC grant.

Here are the key features of the ScaleOcean software:

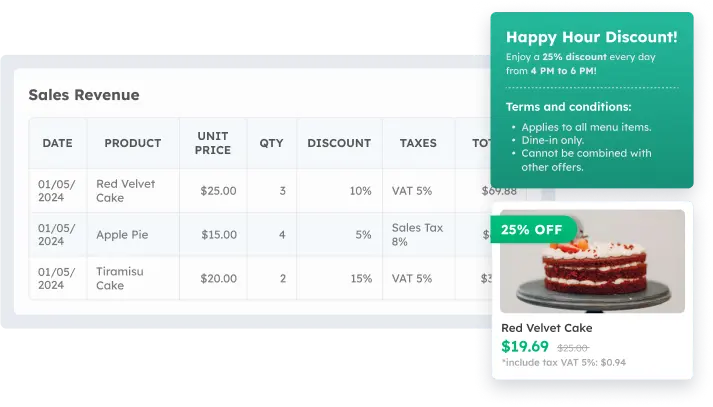

- Dynamic Pricing Automation: Optimizes revenue stream management by automating tariff and price adjustments based on real-time data.

- AI-Powered Sales and Market Trend Analysis: Uses artificial intelligence to identify trends and predict sales patterns, enhancing decision-making.

- Real-Time Revenue Tracking and Identification: Monitors actual revenue in real-time, enabling efficient up-selling and cross-selling strategies.

- Unlimited User Access with No Extra Fees: Provides unlimited user access to revenue reports and visibility, ensuring scalability without hidden costs.

- Automated Revenue Reporting: Generates automated revenue reports that can be accessed at any time, ensuring businesses stay on top of their financial performance.

On top of the unique features we’ve covered, ScaleOcean offers plenty of extra tools designed to help you manage your revenue streams. You can even grab a free demo to try these powerful features yourself and see how they can be customized to fit your specific business needs.

Conclusion

So, here’s the bottom line. Your revenue streams are more than just numbers on a spreadsheet. They’re the heartbeat of your business, shaping decisions, direction, and growth opportunities.

Whether you’re expanding into new markets, refining your offerings, or just trying to understand where the money actually comes from, you need a clear view of every stream.

And when it comes to managing them all in one place, ScaleOcean’s revenue software really does make a difference. The software’s ability to bring all your revenue data under one roof means less guesswork and more strategy. If you’re serious about scaling sustainably, it’s worth a try to use ScaleOcean’s free demo so you can try its unique features firsthand.

FAQ:

1. What is another word for revenue stream?

A revenue stream, also known as an income source, earnings, or revenue flow, refers to how a company generates money from specific activities. These terms are often used interchangeably to describe the different channels through which a business earns its income.

2. How to create 7 streams of income?

1. Sell physical or digital products.

2. Provide services or consulting.

3. Create subscription-based income.

4. License intellectual property for royalties.

5. Monetize content through advertisements or sponsorships.

6. Invest to earn dividends or interest.

7. Rent or lease out assets.

3. How can I create new revenue streams?

1. Understand customer needs and challenges.

2. Explore untapped market niches.

3. Expand your product or service offerings.

4. Introduce subscription or recurring income models.

5. Form strategic partnerships.

6. Utilize technology for automation and scalability.

7. Share your expertise by offering consulting or online courses.

4. What generates 90% of business revenues?

In large corporations, approximately 90% of business revenues come from their extensive operations and diversified product offerings. These businesses have a broader market reach, unlike smaller businesses such as sole proprietorships or partnerships.

PTE LTD..png)

.png)

.png)

.png)

.png)