Accrual accounting is a powerful tool that changes the way companies handle their financial reporting. Instead of waiting for cash transactions, this system records revenues and expenses as they are earned or spent, resulting in a more complete and accurate picture of financial performance.

Accrual accounting helps businesses in Singapore accurately reflect their financial position by recording revenues and expenses when incurred, not when cash changes hands. This aligns with International Financial Reporting Standards (IFRS), ensuring transparency and regulatory compliance. It also supports better financial planning and decision-making.

By adopting accrual accounting, companies can better track financial performance, make informed decisions, and meet the requirements of local regulations. In this article, we’ll explore the different types of accrual accounting and how they can help businesses manage their finances more effectively.

What is Accrual Accounting?

Accrual accounting is a method that records revenues when earned and expenses when incurred, rather than when cash is exchanged. This approach ensures more accurate financial reporting, as it reflects the actual financial performance of a business. Revenue recognition, in which revenue is recognized when earned rather than when paid, is one of the key principles.

Additionally, expense matching ensures that expenses are linked with the revenues they create, giving a more accurate picture of profitability. By adhering to these rules, accrual accounting provides a full perspective of a company’s financial health, allowing for more informed decision-making.

What are the Types of Accrual?

Accrual accounting involves recognizing revenue and expenses when they occur, not when cash is exchanged. There are different types of accruals that help businesses maintain accurate financial records. Here are the main types.

1. Accrued Revenues

Accrued revenues are the amounts earned by a company for goods or services delivered but not yet paid in cash. These revenues are recognized in the period in which they are earned, so that financial records reflect actual performance.

2. Accrued Expenses

Accrued expenses are liabilities that a company has incurred but has not yet paid for. These expenses are recognized during the period in which they occur, ensuring that the company’s financial statements accurately reflect its obligations.

3. Unearned Revenues

Unearned revenue refers to payments made in advance for goods or services that will be delivered in the future. This type of accrual ensures that revenue is recognized only when the service or product is delivered, as per the revenue recognition principle.

4. Prepaid Expenses

Prepaid expenses are payments made in advance for services or goods to be received in the future. These costs are initially recorded as assets and expensed over time as the benefit of the service or product is realized.

Advantages of Accrual Accounting

Accrual accounting tracks financial performance by recording revenues and expenses when earned or incurred, not when cash is exchanged. This method offers a more accurate view of financial health, helping decision-making and ensuring compliance with global standards. Some of the key benefits include:

1. Enhanced Financial Accuracy

Accrual accounting matches revenues with related expenses in the same period, offering a clearer picture of a company’s financial health. This approach eliminates timing discrepancies, ensuring financial statements reflect the true economic activity of the business.

2. Improved Strategic Planning

By providing a realistic view of financial performance, accrual accounting aids in better forecasting and budgeting. Businesses may make more informed decisions, allocate resources better, and plan for long-term growth with greater certainty.

3. Compliance with IFRS

Accrual accounting aligns with International Financial Reporting Standards (IFRS), ensuring consistency and comparability across global markets. This compliance enhances credibility and simplifies financial reporting for multinational companies.

4. Better Cash Flow Management

While accrual accounting focuses on revenue and expenses, it also assists businesses in anticipating future cash flows by tracking payables and receivables. This proactive approach reduces cash flow surprises while improving liquidity management.

5. Enhanced Stakeholder Trust

Accurate and transparent financial reporting builds trust with investors, creditors, and stakeholders. Accrual accounting ensures that financial statements are accurate, instilling trust in the company’s financial stability and performance.

Also read: IRAS Singapore Compliance: Practices and Software Benefits

Disadvantages of Accrual Accounting

While accrual accounting provides a comprehensive view of financial performance, it comes with challenges. Understanding the drawbacks is important for businesses assessing its suitability. Key disadvantages of accrual accounting include:

1. Increased Complexity

Accrual accounting requires meticulous record-keeping and a deep understanding of accounting principles. Tracking revenues and expenses when they are earned or incurred, rather than when cash is exchanged, can be time-consuming and prone to errors without proper expertise.

2. Potential Cash Flow Challenges

Since accrual accounting focuses on revenues and expenses rather than cash transactions, it may not accurately reflect a company’s cash on hand. This can lead to liquidity issues, especially for businesses with tight cash flow.

3, Implementation Costs

The transition from cash to accrual accounting can be resource-intensive, necessitating investments in software, training, and professional knowledge. Small businesses, in particular, may find the initial setup costly and difficult.

4. Difficulty in Short-Term Financial Monitoring

Accrual accounting focuses on long-term financial health, making it difficult to track short-term cash flow. Businesses may struggle to manage day-to-day expenses if they rely solely on accrual-based financial statements. Using a bookkeeping spreadsheet alongside accrual reports can help monitor cash flow more effectively, ensuring better visibility into daily financial operations.

5. Risk of Overstated Revenue

Accrual accounting tracks revenue as it is earned, regardless of whether payment has been received. This can result in exaggerated revenue figures, thereby misleading stakeholders about the company’s true financial situation.

Accrual Accounting vs. Cash Basis Accounting

Accrual accounting and cash basis accounting are two fundamental methods of recording financial transactions, each with its own approach and implications for businesses. Understanding their differences is critical for selecting the best accounting system to meet specific requirements.

1. Recognition of Revenue and Expenses

In accrual accounting, revenues and expenses are recorded when they are earned or incurred, regardless of when cash is exchanged. This means income is recognized when a sale is made, even if payment is received later, and expenses are recorded when goods or services are received, even if payment is deferred.

In contrast, cash basis accounting recognizes revenue and expenses only when cash is actually received or paid. This makes cash basis accounting simpler but less reflective of a company’s true financial position.

2. Financial Accuracy and Reporting

Accrual accounting provides a more accurate and comprehensive view of a company’s financial health by matching revenues with related expenses in the same period. This approach is particularly useful for businesses with complex operations or those that extend credit to customers.

On the other hand, cash basis accounting offers a straightforward view of cash flow but may not accurately represent long-term financial performance, as it ignores outstanding receivables and payables.

3. Compliance and Suitability

Accrual accounting is required for businesses that follow international accounting standards, such as International Financial Reporting Standards (IFRS), making it essential for larger companies or those seeking external funding.

Cash basis accounting, however, is often used by small businesses or sole proprietors due to its simplicity and ease of implementation. It is not compliant with IFRS, limiting its use for larger organizations.

4. Complexity and Resource Requirements

Accrual accounting is more complex, requiring detailed record-keeping and a thorough understanding of accounting principles. It often involves advanced software and professional expertise, making it resource-intensive.

In contrast, cash basis accounting is easier to manage and requires fewer resources, making it ideal for small businesses with limited accounting requirements.

5. Cash Flow Visibility

While accrual accounting provides a clearer picture of overall financial performance, it may not accurately reflect cash flow, as it includes unpaid invoices and expenses.

Cash basis accounting, however, focuses solely on cash transactions, offering a real-time view of available funds but potentially overlooking future financial obligations.

Also read: What is Cloud Accounting and How Does it Work?

Implementing Accrual Accounting in Singapore

Accrual accounting is a fundamental business practice in Singapore, ensuring accurate financial reporting and compliance. This guide delves into the regulatory framework and transition process, outlining a clear path for successful implementation. Leveraging accounting software can further streamline this transition, automating key processes and ensuring accuracy in financial management.

1. Regulatory Framework

Businesses that use accrual accounting must adhere to Singapore Financial Reporting Standards (SFRS). SFRS is consistent with international standards, which ensures transparency and consistency in financial reporting. Compliance not only fulfills legal requirements, but it also boosts credibility among stakeholders, investors, and regulatory agencies.

2. Transition Process

The transition to accrual accounting involves three key steps, including assessing current accounting practices to identify gaps, planning a tailored strategy with timelines and resource allocation, and executing the changes with professional guidance to ensure accuracy and compliance. This structured approach helps minimize disruptions and ensures a smooth shift to accrual-based reporting.

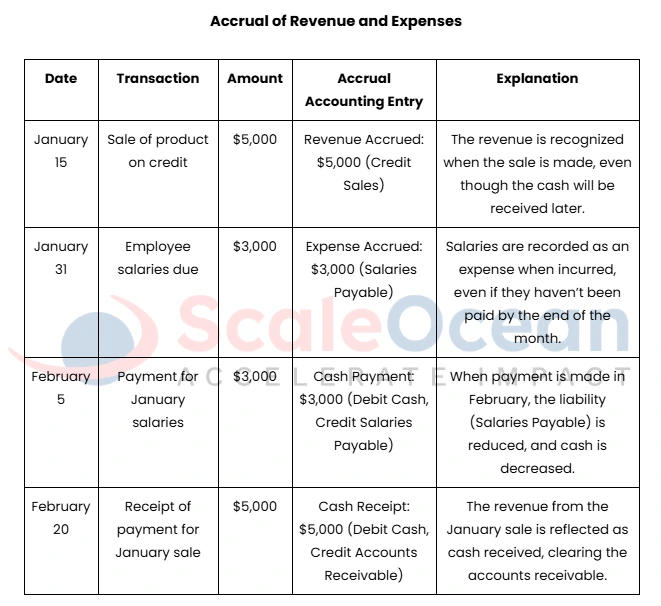

3. Example

Here’s an example of an accrual accounting calculation for a business financial report. In this case, let’s look at the accrual of revenue and expenses over a period.

Explanation:

Revenue Accrued: When the product is sold on credit, the revenue is recognized at the time of the sale, not when the payment is received. This entry ensures that the financial report reflects the actual earned income.

Expense Accrued: The expense for salaries is recorded as soon as it is due, even if the payment hasn’t been made yet. This reflects the costs incurred by the business during the period.

Payment Made: When cash is paid in February for January’s salaries, the liability is cleared, and the cash account is updated to show the payment.

Cash Receipt: When the business receives payment for a sale made in January, accounts receivable is reduced, and cash is increased to show the cash inflow.

Efficient Bookkeeping Strategies with Accrual Accounting

Implementing accrual accounting requires efficient bookkeeping strategies to ensure accuracy and compliance. This guide highlights key practices, including regular reconciliation, employee training, and leveraging accounting software, to streamline financial management and enhance business performance.

1. Regular Reconciliation

Accounts must be consistently updated and reconciled to ensure accurate financial data. Regular reconciliation ensures that revenues and expenses are recorded in the correct period, avoiding discrepancies and ensuring compliance with Singapore Financial Reporting Standards. This practice also aids in early error detection, which improves financial transparency and decision-making.

2. Employee Training

It is important to train employees on accrual accounting. Training programs should emphasize understanding the SFRS, recognizing accruals, and implementing best practices. Employees who have been properly taught can confidently manage complex transactions, reducing errors and maintaining seamless financial operations.

3. Utilize Comprehensive Accounting Software

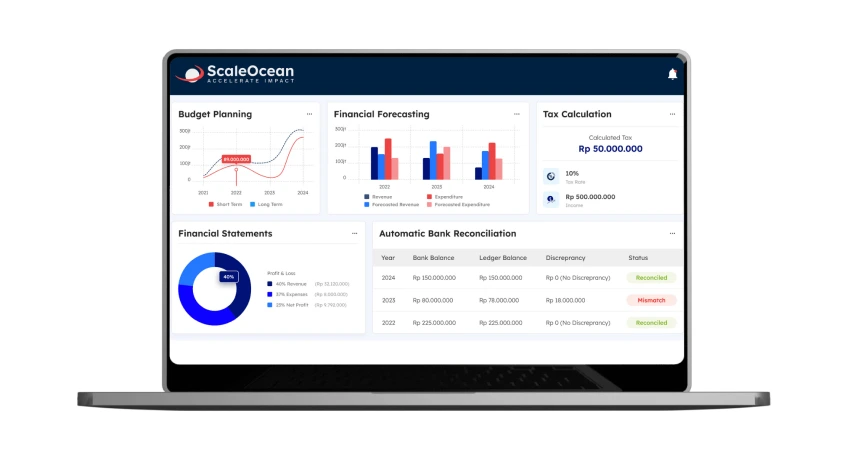

Implementing a strong accounting system is essential and ScaleOcean is a trusted vendor for Singaporean businesses. For companies looking for a solution that aligns with SFRS and integrates smoothly into their operations, ScaleOcean provides tailored accounting solutions specifically designed for accrual accounting. These solutions help businesses maintain accurate financial records.

ScaleOcean’s accounting software not only automates financial processes but also seamlessly integrates with other financial modules to record transactions accurately in real-time, providing reliable insights for decision-making. Moreover, its integration with the CTC grant simplifies payroll and expense management, ensuring compliance with grant requirements and upholding best accounting practices. Discover how ScaleOcean can effortlessly streamline your financial operations and enhance compliance by exploring a free demo.

Key Features:

- Automated Journal Entries: Simplifies the recording of accruals and deferrals, reducing manual intervention.

- Real-Time Financial Reporting: Provides up-to-date financial statements that support informed decision-making and enhance transparency.

- Compliance Assurance: Ensures adherence to Singapore’s accounting standards, helping businesses maintain regulatory compliance.

- Automated Reconciliation: Automatically matches transaction data recorded in the company’s system with bank records, reducing manual errors.

ScaleOcean Accounting Software boosts efficiency by reducing manual data entry and minimizing errors. Its scalability adapts to your business’s growing financial needs, while the user-friendly interface makes it accessible to all staff, enhancing productivity and collaboration. Whether a startup or large enterprise, ScaleOcean ensures accurate, streamlined accounting. Additionally, the system can be adjusted to meet local accounting regulations, ensuring full compliance with regional requirements.

Conclusion

Accrual accounting is a crucial method for businesses aiming to achieve precise financial reporting and meet Singapore’s accounting standards. Although it may come with some challenges, its advantages, including improved financial clarity and better strategic planning, are undeniable. By recognizing revenues and expenses when they are earned or incurred, this approach offers a more accurate reflection of a company’s financial position.

To make the process smoother and more efficient, businesses can leverage advanced accounting software like ScaleOcean, which simplifies the management of accrual accounting tasks. This software automates journal entries, reconciliations, and reporting, reducing errors and manual effort. Seamless integration with business operations ensures real-time financial insights and accurate transaction tracking. ScaleOcean accounting software helps businesses stay compliant, make informed decisions, and adapt as they grow, streamlining financial management with efficiency and ease.

Click to Chat!

Click to Chat!