An accounting system is an essential framework for businesses to manage and streamline financial operations effectively. Accounting systems promote accuracy, transparency, and compliance with legal and regulatory norms by recording, processing, and reporting financial transactions. These systems are critical in keeping structured financial records, allowing firms to track income, expenses, and overall performance.

With features like automation and real-time reporting, an accounting system reduces errors, enhances decision-making, and fosters operational efficiency. Businesses ranging from startups to major businesses rely on these technologies to meet regulatory obligations and assist long-term financial planning.

A recent report indicates that the accounting ERP market in Singapore was valued at USD 481.29 million in 2023 and is projected to reach USD 910.77 million by 2029, growing at a compound annual growth rate (CAGR) of 11.05% during this period. Adopting a robust accounting system not only simplifies complex processes, but also gives businesses insights to stay competitive in today’s fast-paced corporate world.

1. What is an Accounting System?

An accounting system is a structured framework for capturing, recording, processing, and reporting a company’s financial transactions. It serves as the foundation of financial management, systematically tracking cash flow, monitoring assets and liabilities, and generating essential financial statements.

Key components of accounting systems include journals for recording transactions, ledgers for organizing entries by account, and financial statements, such as balance sheets, income statements, and cash flow reports that summarize financial health. Additionally, many systems offer features like accounts receivable, accounts payable, and payroll management. These integrated components ensure accurate records, regulatory compliance, and actionable insights, enabling informed decisions and fostering operational transparency.

2. Importance of Accounting System

Accounting systems help companies by streamlining financial procedures, maintaining accuracy, and giving important information. They enable firms to manage resources effectively and comply with requirements.

a. Accuracy and Compliance

Accounting systems minimize human errors by automating calculations and processes, ensuring precise financial records. They also help businesses comply with tax laws and financial regulations by generating accurate reports and maintaining audit-ready documentation.

b. Informed Decision-Making

These systems provide real-time financial insights through detailed reports and analytics. This allows business executives to make data-driven decisions, track financial health, and strategize for development and sustainability.

c. Operational Efficiency

Automation of repetitive tasks, such as invoicing and payroll, enhances operational efficiency. Accounting systems save time and reduce administrative burdens, allowing employees to focus on value-adding activities that drive business success.

d. Financial Transparency

Accounting systems provide transparency by integrating financial data on a consolidated platform. This enables stakeholders to clearly track spending, revenues, and cash flow, creating internal trust and accountability.

e. Scalability and Integration

Modern accounting systems are designed to scale with business growth and integrate with other tools like ERP and CRM. This enables seamless data exchange across departments, supporting a unified approach to resource management and planning.

3. Types of Accounting Systems

Different types of accounting systems are designed to meet diverse business needs, providing solutions for financial management, compliance, and decision-making. Understanding these types helps organizations choose the most effective system.

a. Manual Accounting Systems

Manual accounting relies on physical records and spreadsheets for tracking transactions. While cost-effective for small businesses, it is labor-intensive and prone to errors, making it less suitable for larger or growing organizations.

b. Computerized Accounting Systems

These systems use software to automate accounting tasks like bookkeeping and report generation. They ensure accuracy, save time, and are scalable for businesses of all sizes, making them widely adopted across industries.

c. Cloud-Based Accounting Systems

Cloud-based systems allow access to financial data anytime, anywhere through the internet. They provide real-time updates, increased security, and integration possibilities, making them suitable for enterprises that need flexibility and remote access.

d. Enterprise Resource Planning (ERP) Systems

ERP systems integrate accounting with other business functions such as inventory, sales, and HR. These comprehensive solutions are best for medium to large organizations needing seamless cross-departmental operations and centralized data management.

e. Hybrid Accounting Systems

Hybrid systems combine on-premise and cloud-based functionalities, offering businesses flexibility in data management. They are suitable for companies transitioning to digital solutions while maintaining some traditional processes for specific operational requirements.

4. Must-Have Features of Accounting Systems

Accounting systems provide essential features that accelerate financial procedures, improve accuracy, and facilitate decision-making. These capabilities enable organizations to manage transactions, generate reports, and prepare budgets more efficiently.

a. Transaction Recording

Accounting systems automate transaction recording, ensuring accuracy and consistency in tracking income, expenses, and other financial activities. This feature reduces manual errors and provides a reliable foundation for financial analysis and reporting.

b. Financial Reporting

Robust financial reporting tools generate key documents including income statements, balance sheets, and cash flow reports. These features provide real-time financial health information, allowing firms to stay compliant and make informed decisions.

c. Accounts Management

Managing accounts receivable and payable efficiently simplifies creating invoices, tracking payments, and handling collections. Accounting systems help optimize cash flow and lower the chances of missed or late payments.

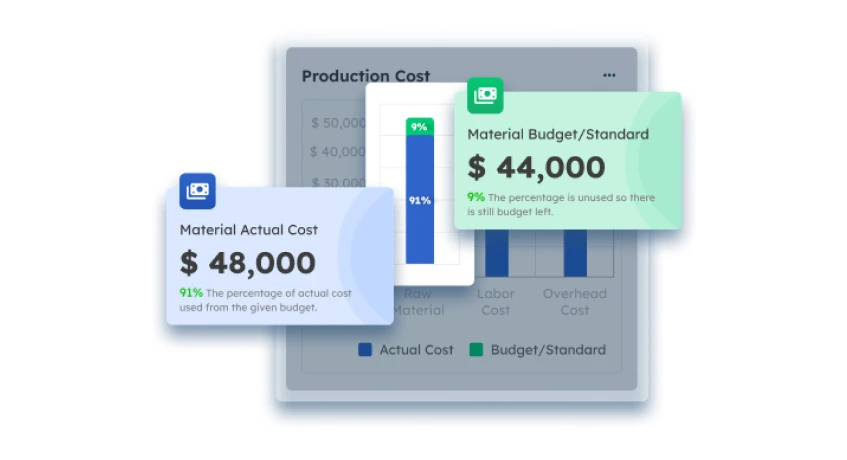

d. Budgeting and Forecasting

Businesses use advanced budgeting and forecasting systems to prepare for future spending, allocate resources, and anticipate financial outcomes. These tools help you create achievable goals and prepare for potential financial issues.

e. Tax Compliance Automation

Accounting systems simplify tax calculations and filing by automating processes like VAT tracking and tax return preparation. This feature reduces errors, ensures tax compliance with regulations, and saves time during tax seasons.

5. Key Processes in Accounting System

Accounting systems handle important tasks to ensure accurate finances, compliance, and better decisions. These processes include recording transactions, maintaining ledgers, generating reports, managing budgets, and ensuring regulatory adherence.

a. Transaction Recording

Transaction recording process involves capturing all financial activities, such as sales, purchases, and payments, in journals or software. Accurate transaction recording ensures a reliable foundation for subsequent accounting activities and financial analysis.

b, Ledger Management

Ledgers consolidate transaction data by account and categorize revenue, expenses, assets, and liabilities. An efficient general ledger system ensures businesses can consistently monitor financial activity and generate reliable financial statements for decision-making. Proper ledger management is critical for maintaining accuracy and transparency in your financial records.

c. Financial Reporting

Accounting systems generate important financial statements like income statements, balance sheets, and cash flow reports. This process provides stakeholders with insights into the business’s financial performance and compliance readiness.

d. Budgeting and Forecasting

Budgeting involves allocating resources based on financial data, while forecasting predicts future financial trends. This process helps businesses make informed decisions, control expenses, and prepare for growth opportunities or challenges.

e. Compliance and Auditing

Accounting systems facilitate adherence to tax regulations and financial standards by automating tax calculations and maintaining audit trails. This procedure ensures legal compliance and simplifies external and internal audits.

6. Differences Between Single-Entry and Double-Entry Accounting Systems

Single-entry and double-entry accounting systems are the two primary methods for recording financial transactions, each serving different business needs. The single-entry system is simpler and ideal for small businesses with straightforward financial activities, while the double-entry system offers greater accuracy and comprehensive tracking, making it suitable for larger or more complex organizations.

Understanding these distinctions is crucial for companies to choose the approach that aligns with their operational scale, financial complexity, and reporting requirements. By selecting the right method, businesses can ensure better financial management and compliance. Here are the main differences, summarized in the table below, to help you make an informed decision.

| Single-entry Accounting System | Double-entry Accounting System |

|---|---|

|

|

7. How to Choose the Right Accounting System?

Choosing the right accounting system is important for any business, as it ensures accurate financial records, supports compliance, and improves operational efficiency. A well-suited system can streamline processes, save time, and provide valuable insights for informed decision-making.

a. Assess Your Business Needs

Start by identifying your business’s specific requirements to ensure the software aligns with your operations. Evaluate factors like your industry, company size, transaction volume, and team expertise to avoid unnecessary features and choose a solution tailored to your needs.

b. Consider Integration Capabilities

Ensure the software can seamlessly integrate with essential tools such as e-commerce platforms, payment systems, payroll software, and banking tools. This compatibility reduces manual data entry, minimizes errors, and streamlines workflows for a more efficient operation.

c. Evaluate User-Friendliness

Choose accounting software that is easy to use, even for non-experts. The best accounting software offers includes features like clear dashboards, configurable reports, and built-in tutorials. User-friendly technologies save time, increase productivity, and minimize the need for extensive training.

d. Analyze Cost

Determine the total cost of ownership, which includes subscription fees, setup costs, training, and continuing support. Understanding the cost breakdown structure is essential for evaluating the financial implications of your investment. Compare pricing models, such as per-user subscriptions or tiered plans, to find a solution that fits your budget without compromising on essential features.

8. ScaleOcean Singapore: A Leading Accounting Software Solution

In today’s rapidly evolving business landscape, effective financial management can distinguish a company from its competitors. ScaleOcean’s Accounting Software provides a comprehensive and integrated solution tailored to streamline financial processes while ensuring compliance with regulatory standards, including IFRS. This powerful software facilitates end-to-end financial reporting, automates essential tasks such as transaction recording, and integrates effortlessly with external systems, enhancing overall operational efficiency.

Specifically designed to support Singaporean enterprises, ScaleOcean enables businesses to manage their finances accurately and adapt to local compliance requirements. To explore its full range of features, companies can access our free demo, allowing them to see how ScaleOcean can be customized to meet their specific needs.

Key features:

- Auto-Reconciliation: Automatically matches bank transactions with internal records, ensuring consistent financial tracking.

- Customizable Financial Reports: Offers tailored reports aligned with company-specific and regulatory requirements.

- Real-Time Integration: Syncs data across modules for a holistic view of operations.

- IFRS Compliance: Generates accurate reports that adhere to local accounting standards.

- Cash Flow Monitoring: Provides insights into liquidity trends for better financial decision-making.

ScaleOcean’s Accounting Software helps businesses simplify complex financial procedures, decrease human error, and boost productivity. Its seamless integration with other corporate operations provides accurate data flow and agile decision-making. ScaleOcean promotes growth and compliance by ensuring that operations adhere to local and international standards. Customization adds flexibility to the system, allowing organizations of all sizes and industries to easily adapt to individual needs.

9. Conclusion

Adopting an effective accounting system is essential for ensuring financial accuracy, streamlining processes, and driving business growth. A well-chosen system not only supports compliance but also provides valuable insights to guide informed decision-making. To maximize these benefits, businesses should assess their unique operational needs and consult with financial experts to select the most suitable solution.

By investing in the right accounting system, companies can establish a strong foundation for sustainable growth and operational efficiency. A well-designed system simplifies financial processes, reduces errors, and supports better decision-making across the business. ScaleOcean offers a free demo to help you explore how the right solution can bring tangible improvements to your organization.

Click to Chat!

Click to Chat!