The Inland Revenue Authority of Singapore (IRAS) is the major government agency in charge of administering taxes and disbursement systems in Singapore. Singapore, a worldwide financial hub, relies on a strong and efficient tax system to fund its infrastructure and public services.

IRAS is critical to maintaining this system by assuring compliance while encouraging economic competitiveness and innovation. The agency’s efforts not only ensure equal tax collection, but also promote a business-friendly atmosphere that encourages international investment.

1. What is IRAS?

The Inland Revenue Authority of Singapore (IRAS) is a governmental authority in charge of collecting taxes and enforcing tax rules in Singapore, ensuring that individuals and corporations meet their tax duties efficiently.

Established in 1947 as the Inland Revenue Department, IRAS became a statutory body in 1992. Over the years, it has received global acclaim for its efficiency, innovation, and commitment to streamlining tax operations, consolidating its position as a tax administration leader and Singapore’s trusted tax authority.

2. Roles and Responsibilities of IRAS

The foundation of Singapore’s tax system, IRAS makes sure that the tax structure functions efficiently. It upholds the principles of justice and conformity, facilitating the smooth operation of the economy and advancing the general good. The many operations of IRAS have a major role in Singapore’s rise to prominence as a global center of commerce.

IRAS, which is based on Global Link Consulting, works with more than 120 software suppliers to develop products like InvoiceNow and One-Stop Payroll that streamline business tax compliance and increase operational effectiveness. Its main duties include the following:

a. Tax Collection

IRAS manages a variety of taxes, including income tax, goods and services tax (GST), property tax, and stamp duty, to ensure precise and effective revenue collection. This method provides funding for important public services such as healthcare, education, and infrastructure.

IRAS has expedited tax collection by deploying modern digital solutions that reduce errors and improve the taxpayer experience. Its efforts ensure that all taxpayers contribute equally to Singapore’s development.

b. Taxpayer Services

IRAS provides full support to taxpayers, including information, resources, and tools to help them comply with tax requirements. This includes services such as tax preparation assistance, hotlines, and online resources that address frequent questions.

IRAS encourages taxpayers to comply voluntarily by promoting openness and confidence. These services not only boost taxpayer confidence, but they also increase overall tax administration efficiency.

c. Policy Development

IRAS works with the government to create and modify tax policies that are consistent with Singapore’s economic objectives and global competitiveness. This involves ensuring that the tax system can adapt to new trends and challenges, such as digitalization and globalization.

By regularly examining and strengthening tax regulations, IRAS contributes to Singapore’s position as an appealing business destination. Its proactive approach guarantees that tax policies are relevant, egalitarian, and growth-oriented.

3. Importance of IRAS for Businesses

In order to promote an open and equitable business climate, IRAS is essential for Singaporean companies. By guaranteeing adherence to Singapore’s IRAS tax laws, IRAS assists companies in running efficiently and preserving their reputation. Its rules encourage moral behavior in addition to lowering the possibility of financial punishment.

IRAS also promotes Singapore’s economic stability, which helps the country’s corporate community. According to the Ministry of Finance, IRAS provided over 120,000 businesses with $4.6 billion in grants in 2023 alone, highlighting the organization’s important role in fostering economic resilience and assisting businesses.

a. Tax Compliance

IRAS guarantees that firms follow IRAS tax Singapore legislation, promoting a level playing field and avoiding unwarranted penalties. Compliance with these standards enables firms to create confidence with stakeholders such as investors and customers.

Businesses that adhere to IRAS rules can also streamline their financial procedures, minimizing errors and inefficiencies. Finally, continual compliance with tax regulations protects the reputation and longevity of any Singapore-based firm.

b. Economic Contribution

IRAS generates cash to support public services and infrastructure development, benefiting both enterprises and citizens. The monies collected by IRAS are critical for developing and maintaining Singapore’s world-class infrastructure, which fosters corporate growth.

Furthermore, this cash supports social initiatives that improve the quality of life for workers, resulting in a more productive and inventive economy. Businesses contribute to the nation’s development, ensuring long-term sustainability and prosperity for everybody.

Also Read: Free Online ERP System Demo: Why Is It Important?

4. Staying Compliant with IRAS

Compliance with IRAS laws is an important component of corporate operations in Singapore. Businesses that keep correct records, meet tax deadlines, and use the right tools can avoid penalties and assure seamless, efficient tax reporting. The following are critical measures that can help firms stay compliant and reduce the likelihood of difficulties with Singapore’s Inland Revenue Authority.

a. Record-Keeping

Maintaining accurate and up-to-date financial records is required for IRAS online tax payment and reporting. These records provide a comprehensive picture of financial activity, making it easier to spot anomalies and remedy errors.

Regular audits of financial records, particularly the general ledger, guarantee that the information supplied to IRAS is accurate and in accordance with tax requirements. Effective record-keeping assists firms in preparing for prospective tax audits, lowering the risk of penalties and disputes.

b. Timely Filings

Adhering to tax filing dates allows firms to avoid penalties and preserve a good status with the IRS. Late filings might incur fines and interest charges, affecting cash flow and business efficiency.

Setting reminders and utilizing digital tools can assist guarantee that deadlines are met consistently. Businesses that file their taxes on time demonstrate dependability and trustworthiness to IRAS and other stakeholders.

c. Utilizing Approved Accounting Software

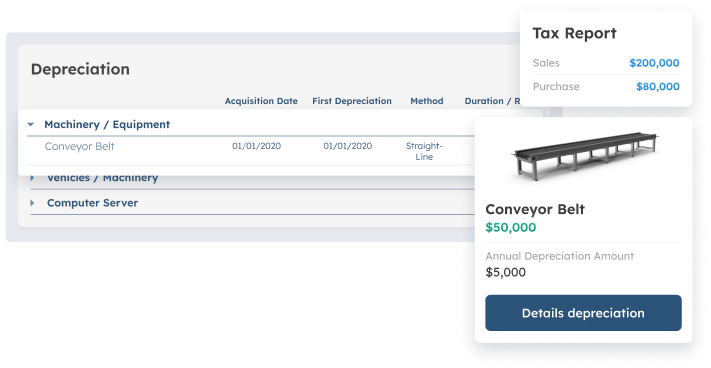

Using IRAS-approved accounting software streamlines tax reporting and ensures accuracy, making compliance easier and more efficient. These technologies are intended to integrate seamlessly with IRAS systems, minimizing manual effort and errors.

Automated features enable businesses to track costs, generate reports, and submit taxes more effectively. Companies that employ certified software linked into an ERP system can remain ahead of regulatory changes while also streamlining their overall tax administration procedures.

Also Read: Understanding the Risk and Benefits of ERP Systems

5. Recommended Accounting Software for IRAS Compliance

Leveraging IRAS-approved accounting software streamlines compliance by allowing for seamless connectivity with IRAS systems. These technologies assist firms avoid manual errors, improve tax filing efficiency, and maintain compliance with Singapore’s Inland Revenue Authority standards. Companies that use the correct accounting software Singapore can focus on core activities while reducing the difficulties of tax management.

a. Benefits

Adopting IRAS-approved accounting software provides a number of benefits that go beyond compliance. These solutions assist firms in optimizing financial administration, increasing productivity, and ensuring accurate tax reporting. The following are the primary features that make these solutions vital for Singapore-based organizations.

- Accuracy, Using IRAS-approved accounting software considerably decreases the likelihood of financial data entry errors. Automated features ensure that computations and data inputs are constant, which helps firms avoid errors during tax filing. Companies can create confidence with IRAS by providing accurate data while preserving compliance and operational reliability.

- Efficiency, These solutions simplify the preparation and submission of tax returns, saving time and resources. Accounting software decreases inefficiencies and the workload of finance personnel by automating repeated tasks. Businesses can focus their resources on more strategic operations, increasing overall productivity and effectiveness.

- Compliance, IRAS-approved accounting software assures strict compliance with Singapore’s tax requirements. The systems are designed to meet all reporting requirements, reducing the possibility of penalties for noncompliance. With updated features that match the most recent tax laws, firms may keep ahead of regulatory changes and maintain a compliant financial environment.

b. ScaleOcean’s Best Accounting Software for Singapore Businesses

ScaleOcean Accounting Software is intended to meet IRAS tax compliance requirements by automating tax reporting and facilitating IRAS online tax payment. Automated tax calculations, real-time IRAS connection, and customisable reports improve efficiency and accuracy.

Businesses can improve financial accuracy and compliance by using IRAS-approved accounting software and benefiting from the CTC Grant to offset costs. Learn more and schedule a free demo today!

- Automated Tax Calculation, Reduces the need for manual calculations, resulting in more accurate GST and income tax returns. This function decreases the possibility of human error and improves the accuracy of financial records.

- Real-Time Integration with IRAS Systems, Allows for seamless data submission, which reduces delays and errors. Businesses may monitor submission status in real time, assuring transparency and compliance.

- Customizable Financial Reports, Provides customizable reporting choices to meet specific business objectives. These reports give actionable information that allow businesses to make informed decisions.

- User-Friendly Interface, Simplifies navigation and reduces employee training time. Its simple design enables even non-technical people to easily manage complex financial activities.

- 24/7 Customer Support, Ensures that any technological issues are rectified swiftly, allowing operations to run smoothly. Dedicated support teams provide advice on how to maximize software capabilities and ensure continuous compliance.

6. Conclusion

Compliance with IRAS laws is critical for Singapore businesses seeking to avoid penalties, expedite processes, and contribute to economic development. Investing in IRAS-approved accounting software makes tax reporting easier, minimizes errors, and increases efficiency.

These solutions not only verify compliance, but also provide useful information for making smarter financial decisions. To get started, businesses can request a free demo to discover how these solutions can be adjusted to their specific requirements while being fully compliant with Singapore’s tax rules.

Click to Chat!

Click to Chat!